Top Tips for Managing Student Loan Debt After Graduation

Written by

weFiGraduating is a milestone, but it often comes with a not‑so‑celebratory sidekick, student loan debt. The good news? Countless graduates have navigated this challenge successfully, and you can too. Below are actionable tips, each paired with inspiring real-life success stories from U.S. grads to make the advice feel tangible and achievable.

Why Managing Student Loans Matters

Student loan debt continues to be a significant financial burden for many Americans. As of the end of 2024, the average student loan debt per borrower was $38,375, according to Federal Student Aid. The total outstanding student loan debt in the United States reached $1.77 trillion, encompassing both federal and private loans. Without a structured repayment plan, this debt can become overwhelming, affecting borrowers' financial stability and future goals.

But with intentional planning just like budgeting, debt repayment becomes manageable. That’s where practical tips, smart tools, and real stories come in.

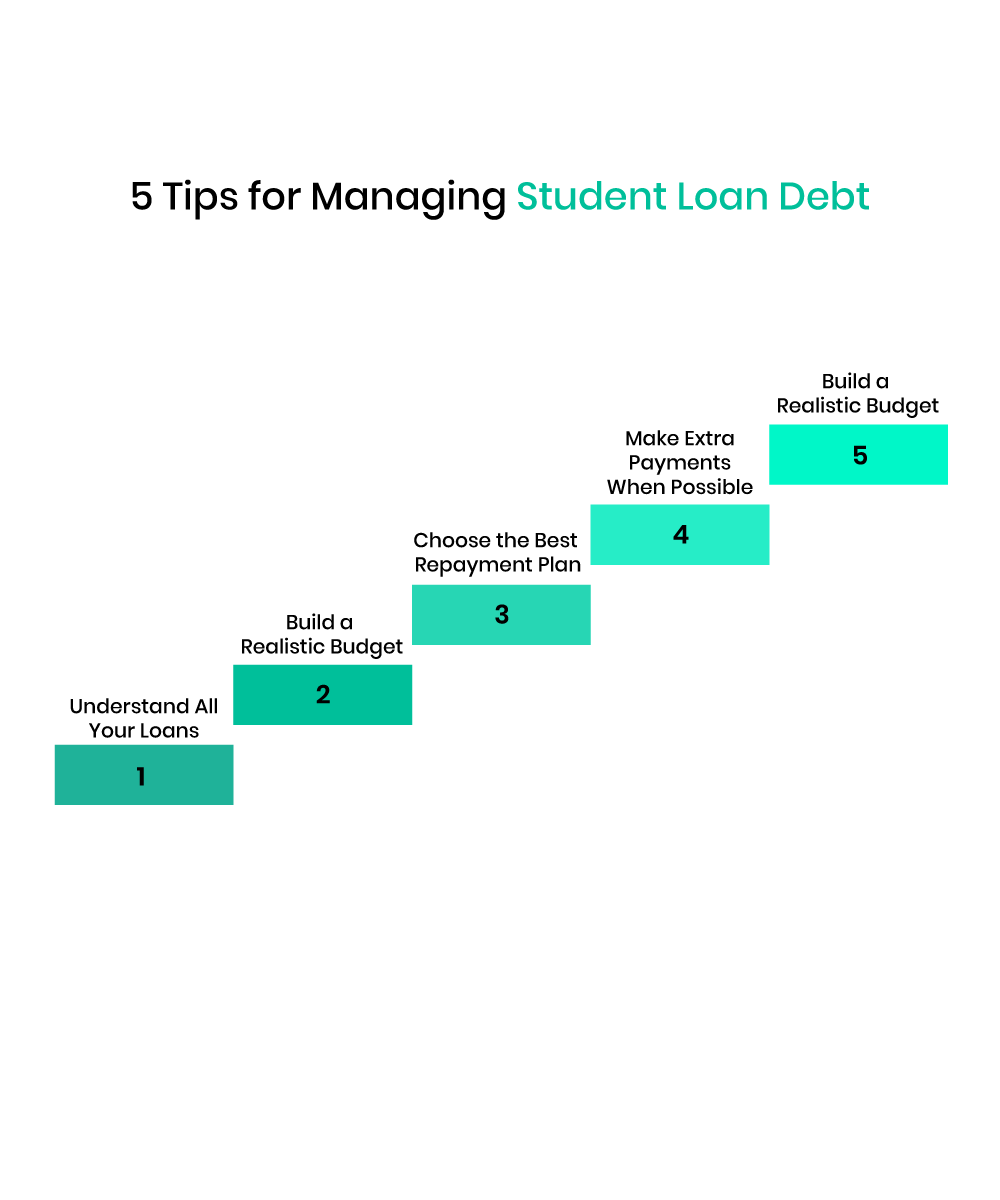

5 Tips for Managing Student Loan with Real-Life Examples

1. Understand All Your Loans

Tip: Use the National Student Loan Data System (NSLDS) to view all your federal student loan details like balances, interest rates, and servicers, in one place.

Example: Shalae Morgan, a financial expert, emphasized the importance of understanding your total loan balance by checking the NSLDS. By doing so, she successfully paid off $173,000 in student loans in less than two years.

Source: The US Sun

2. Build a Realistic Budget

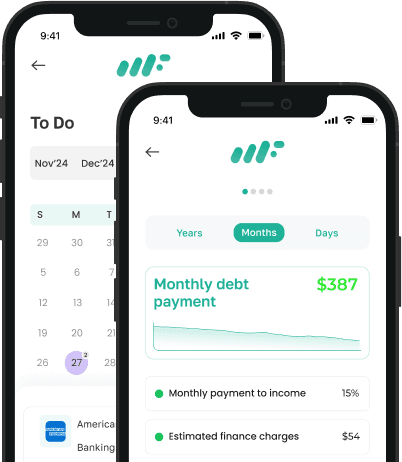

Tip: Implement budgeting strategies like the 50/30/20 rule and utilize tools such as weFi to monitor income and expenses effectively.

Example: Bradley Alagna, a 32-year-old from New England, paid off his student loans by saving 77% of his income. He cut back on nearly everything and stuck to a tight budget, making it easier to stay on top of his $860 monthly payments.

Source: New York Post

3. Choose the Best Repayment Plan

Tip: Explore federal repayment options like Income-Driven Repayment (IDR) plans, including Pay As You Earn (PAYE) and the Saving on a Valuable Education (SAVE) plan, to align payments with your income.

Example: Stephanie Jones and her husband chose to forgo Public Service Loan Forgiveness and instead aggressively paid down over $130,000 in student loan debt.

Source: EDCAPNY.org

4. Make Extra Payments When Possible

Tip: Making extra payments toward your student loans can significantly reduce the total interest paid and shorten the repayment period. Not sure where to start? Two popular strategies to consider are:

Strategy | Avalanche | Snowball |

What it is | Pay off the loan with the highest interest rate first | Pay off the smallest loan balance first |

Main goal | Save the most money on interest over time | Build motivation with quick wins |

Good | People who care about debt cost | People who need fast progress to stay motivated |

Pros | Cuts down interest; most efficient long-term | Helps you stay consistent; rewarding early results |

Cons | Progress feels slower at the start | May cost more in interest over time |

Feels like | A slow start but a stronger finish | A fast start that builds confidence |

Example: Brooke Eichenbaum, a physical therapist from Miami, started with $137,000 in student loans and $29,000 in a car loan. By cutting expenses, cooking 99% of her meals at home, and putting $2,000 a month toward her student loan, she brought her total debt down to $80,000 in just three years, all without giving up her long-term goals.

Source: The Sun

5. Refinance Smartly

Tip: If you have strong credit, a steady income, and aren’t relying on federal protections like income-driven repayment or forgiveness, refinancing might help. A lower interest rate could save you thousands over the life of the loan. Just make sure the trade-offs are worth it, once you refinance federal loans with a private lender, you can’t go back.

Example: Bernadette Joy, a first-generation American, paid off over $300,000 in debt including student loans by making bold financial decisions. Refinancing was a key part of her strategy. She also downsized her lifestyle, avoided unnecessary spending, and built multiple income streams to speed up her progress.

Source: MarketWatch

Ready to Tackle Your Debt?

Managing student loan debt doesn’t require perfection, just a plan. Use weFi to track your income, organize loan payments, and reach your financial goals with clarity and control. Remember, every small step takes you closer to financial freedom.

Frequently Asked Questions

What is the grace period for student loans after graduation?

Most federal student loans offer a six-month grace period after graduation. During this time, you’re not required to make payments, but interest may still accrue.

Should I refinance or consolidate my student loans?

Consolidation combines multiple federal loans for simplicity but won’t lower your interest rate. Refinancing may lower your rate through a private lender but removes federal protections.

What repayment plans are available for federal student loans?

Federal loans offer Standard, Graduated, and Income-Driven Repayment (IDR) plans like SAVE, PAYE, and REPAYE. IDR plans can lead to loan forgiveness after 20–25 years.

How do I qualify for Public Service Loan Forgiveness (PSLF)?

To qualify, you must work full-time for a nonprofit or government employer, make 120 qualifying payments, and have Direct Loans under a qualifying repayment plan.

What happens if I default on my student loans?

Defaulting may lead to wage garnishment, tax refund offsets, and credit damage. Options include loan rehabilitation and consolidation to regain good standing.

How can I lower my monthly payments?

You can lower your payments by enrolling in an income-driven plan, consolidating federal loans, refinancing (if eligible), or using employer repayment benefits.

What resources can help manage student loans?

Key resources include studentaid.gov, your loan servicer for account-specific help, financial advisors for personalized guidance, and tools like weFi, a budgeting app that also helps you track your savings goals and manage loan payments, including student loans.