How to Track Your Earnings Without the Stress

Written by

weFiKeeping tabs on your income doesn’t have to be overwhelming. Whether you’re a freelancer, full-time employee, or juggling multiple income streams, tracking your earnings is the foundation of financial clarity and peace of mind.

In a world of fast payments, shifting work styles, and rising costs, knowing what you actually earn is more important than ever. Let’s break down how to do it, without the stress.

Why Tracking Earnings Matters

Here’s why tracking income regularly is essential:

Helps you budget realistically: You can't spend wisely if you don’t know what’s coming in.

Improves savings discipline: When you track earnings, saving becomes intentional.

Avoids surprises during tax season: Especially if you freelance or earn side income.

Supports long-term goals: From paying off debt to investing or buying a home.

Yet many people still struggle with this simple habit. According to a 2024 Bankrate survey, only 29% of Americans reviewed their budget within the past 30 days, revealing how many overlook income tracking fundamentals.

Common Challenges (and Smart Fixes)

1. Irregular Income

If you’re self-employed or have side gigs, income may vary month to month.

Fix: Use your lowest-earning month as a baseline and treat anything above it as bonus income.

2. Too Many Sources

It’s easy to lose track when income comes from jobs, apps, freelance work, and transfers.

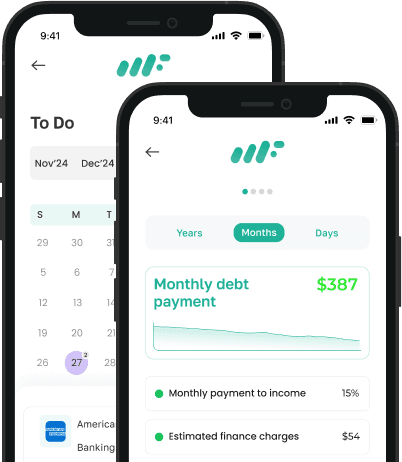

Fix: Use a centralized personal finance app like weFi that connects to all your accounts and categorizes income automatically.

3. Manual Tracking Fatigue

Spreadsheet tracking gets old and often gets abandoned.

Fix: Automate where possible. Let digital tools do the work and only review the data weekly.

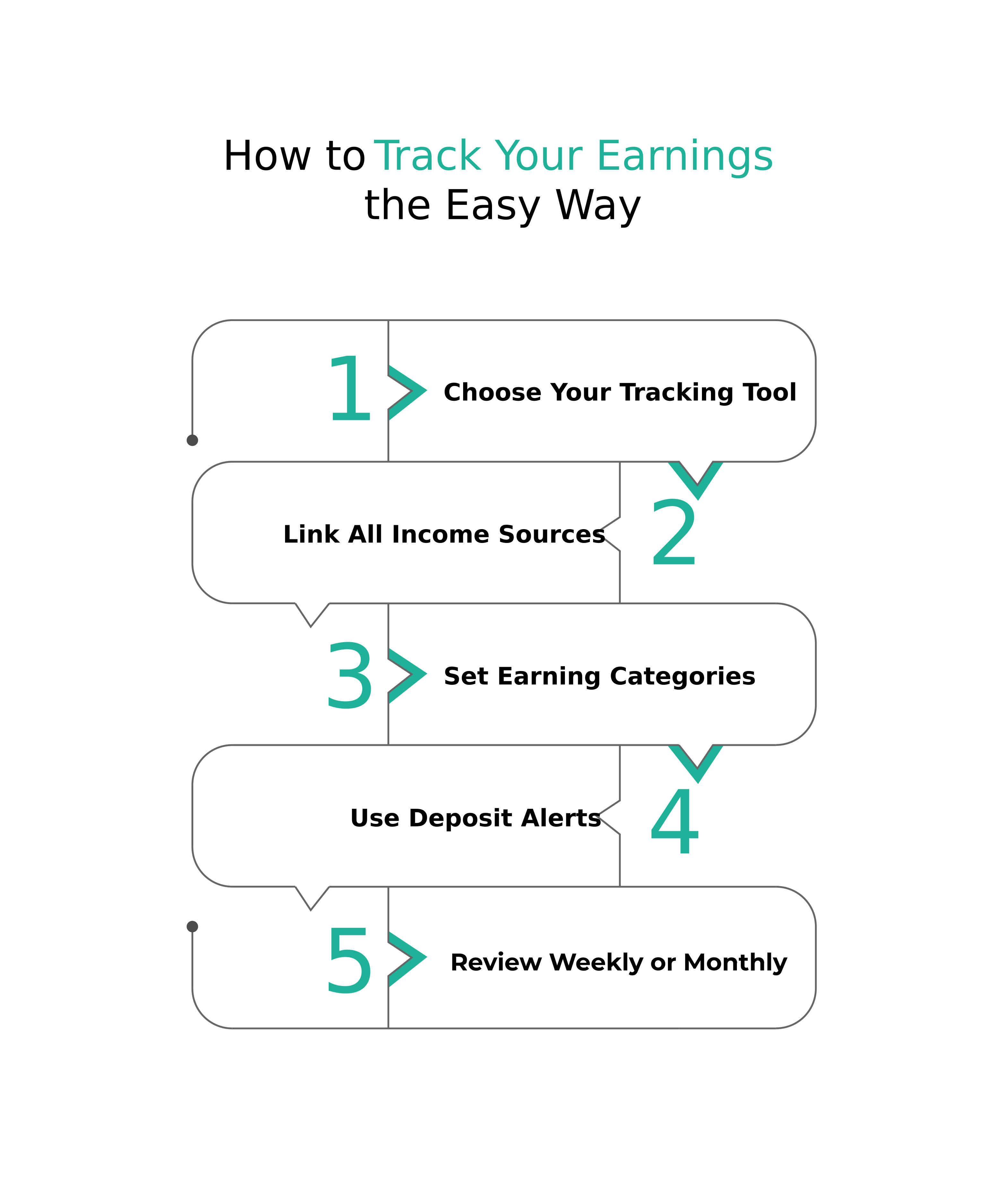

How to Track Your Earnings the Easy Way

Step 1: Choose Your Tracking Tool

Whether it’s weFi or a spreadsheet, pick one place to see everything.

Step 2: Link All Income Sources

This includes:

Paychecks

Side hustles

Freelance payments (Pay-Pal, Stripe, etc.)

Passive income (interest, dividends)

Step 3: Set Earning Categories

Group your income by type; salary, freelance, rental income, etc. This helps you spot patterns over time.

Step 4: Use Deposit Alerts

Enable real-time deposit alerts via your bank or weFi. Know exactly when and how much money hits your account.

Step 5: Review Weekly or Monthly

Don't just track, analyze. What changed? What has improved? Where are you growing?

Avoid These Mistakes

Only tracking gross income: Always focus on post-tax income, that’s what you can actually spend.

Ignoring one-off payments: Refunds, bonuses, or gifts may impact budgeting if not tracked.

Not syncing tools regularly: Ensure your income data is updated weekly or more.

Final Thoughts

Tracking earnings doesn’t require financial expertise. With the right habits and tools, you can simplify the process and actually enjoy the benefits. Less stress, more awareness, and a better grasp of your financial life.

Start today with weFi App and stay on top of every dollar that comes in.

Frequently Asked Questions

What’s the best way to track earnings from multiple jobs?

Use a centralized personal finance tool like weFi to connect all your bank accounts, so income is tracked automatically and categorized.

How often should I check my income records?

Ideally, review them weekly to stay on top of changes, identify missed payments, and keep your budget aligned.

Do income tracking tools affect my credit or taxes?

No, income tracking tools only monitor your bank data. They don’t affect your credit or report to the IRS.

Is it worth tracking small or irregular payments?

Yes, even small payments add up. Tracking them improves budgeting accuracy and financial awareness.