How to Monitor and Reduce Your Debt Step-by-Step

Written by

weFiManaging debt doesn’t have to feel overwhelming. Whether you're dealing with student loans, credit cards, or medical bills, a clear strategy can help you take back control. This guide breaks down actionable ways to monitor and reduce your debt without the stress.

Why Managing Debt Matters Now More Than Ever

Americans collectively hold over $17.6 trillion in household debt as of Q1 2024 (Federal Reserve). Meanwhile, a 2023 Bankrate survey shows that nearly 40% of adults carry credit card debt month-to-month, often at interest rates exceeding 20%.

When left unchecked, debt can impact:

Your credit score

Your ability to qualify for future loans

Your mental health and day-to-day stability

But here's the good news: With the right steps, you can reduce your debt and build a more secure financial future.

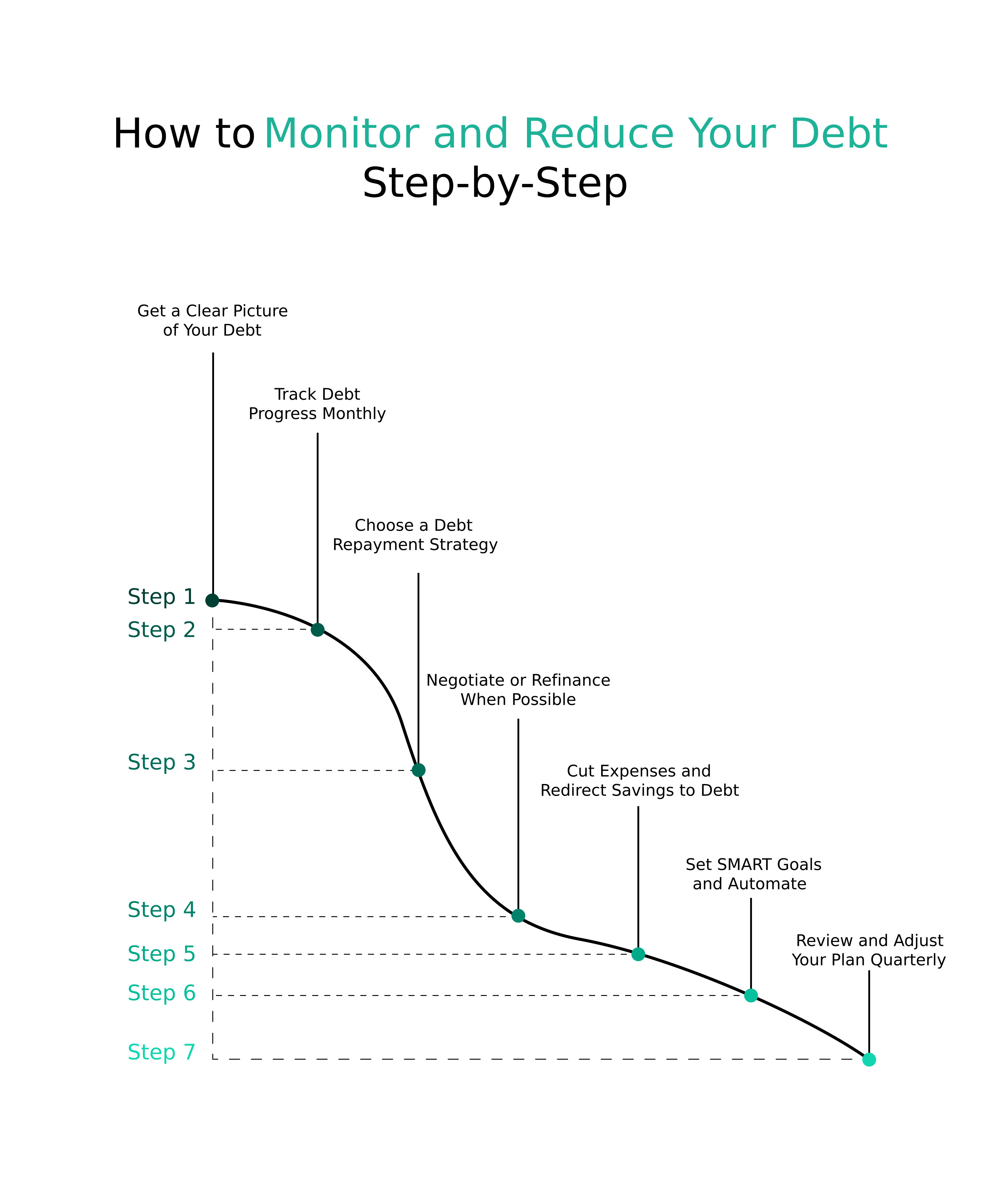

Step 1: Get a Clear Picture of Your Debt

Start by gathering the full list of your debts:

Credit cards

Personal loans

Student loans

Auto loans

Medical bills

Any unpaid collections

Step 2: Track Debt Progress Monthly

Consistency matters. Here’s how to stay on top:

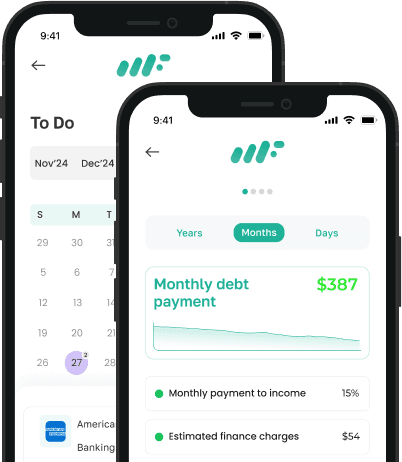

Use apps like weFi App to get real-time payment alerts and progress updates

Record payments and remaining balances in a spreadsheet or budgeting app

Set calendar reminders for due dates to avoid late fees

Tracking helps you stay motivated and ensures you never miss a payment.

Step 3: Choose a Debt Repayment Strategy

Two proven strategies can help you tackle debt systematically:

🔹 Debt Avalanche

Focus on debts with the highest interest rates first

Saves you the most money in the long term

🔹 Debt Snowball

Pay off the smallest balances first

Builds quick momentum and motivation

Stat: According to the American Psychological Association, people using a structured repayment method like Snowball or Avalanche report, higher emotional satisfaction during repayment.

Step 4: Negotiate or Refinance When Possible

Explore your options:

Call lenders to negotiate interest rates or payment plans

Transfer high-interest balances to a 0% APR card (if eligible)

Consider debt consolidation through a personal loan or financial advisor

Always check how any changes might impact your credit.

Step 5: Cut Expenses and Redirect Savings to Debt

Look at your spending:

Eliminate unused subscriptions

Cook more at home

Reduce discretionary purchases

Every extra $20-50/month can accelerate your debt payoff by months or even years.

Step 6: Set SMART Goals and Automate

Set debt-reduction goals that are:

Specific: “Pay off $5,000 in 12 months”

Measurable: Track monthly progress

Achievable: Based on your income

Relevant: Tied to your financial well-being

Time-bound: Have a target date

Step 7: Review and Adjust Your Plan Quarterly

Life changes, your plan should too. Revisit your budget and repayment strategy every 3 months or after:

Job change

Medical expenses

Moving

Family changes (e.g. marriage, kids)

Final Thoughts

Reducing debt isn’t about big leaps, it’s about consistent, small wins. By tracking your progress, choosing a strategy, and staying accountable, you're not just lowering your balances, you’re building financial freedom.

Frequently Asked Questions

Should I pay off the smallest debt first or the one with the highest interest?

Use the Avalanche method if your priority is saving on interest, start with the highest-rate debt. Choose the Snowball method if you need motivational wins, pay off the smallest balance first.

Can regular debt tracking improve my credit score?

Yes. Timely payments, consistent monitoring, and maintaining low credit utilization all contribute to better credit scores over time. It also helps you catch errors or fraud that could lower your score.

When does debt consolidation make sense?

Debt consolidation can be useful if it reduces your interest rate, simplifies multiple payments, or improves repayment consistency. However, it only works if you avoid accumulating new debt.

How often should I review my debt progress?

Check your debt status monthly, or bi-weekly if you're aggressively repaying. Set calendar reminders or enable app alerts to track repayment and adjust based on income or spending changes.