The Ultimate Beginner’s Guide to Budgeting

Written by

weFiBudgeting isn’t about restriction, it’s about direction. Whether you're trying to break the paycheck-to-paycheck cycle, save for a big milestone, or simply feel more in control of your finances, this beginner’s guide will walk you through everything you need to get started clearly, practically, and without stress.

Why Budgeting Matters

According to a 2024 CNBC report, 58% of Americans live paycheck to paycheck, and 61% say they feel anxious about their finances. Budgeting is the tool that changes that narrative. It gives structure to your spending, ensures your goals are funded, and reduces daily money stress.

"Budgeting is telling your money where to go instead of wondering where it went." - John Maxwell

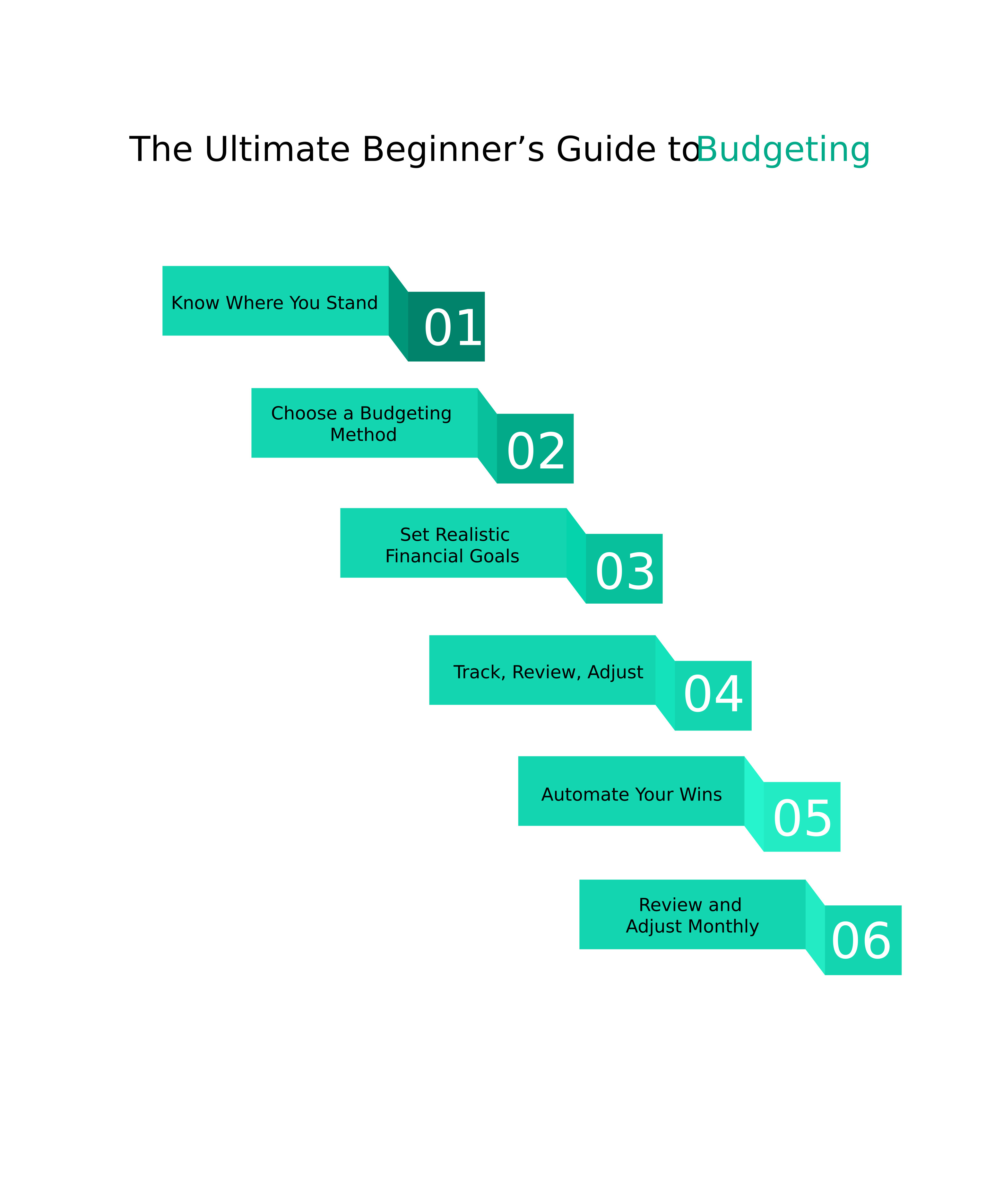

Step 1: Know Where You Stand

Start with a full financial snapshot. List:

All sources of income (take-home pay, side gigs, etc.)

Fixed expenses (rent, utilities, insurance)

Variable expenses (groceries, entertainment, transportation)

Debt payments (credit cards, loans)

Savings and investments (if any)

Use a spreadsheet, journal, or financial app, whichever feels sustainable.

Step 2: Choose a Budgeting Method

There’s no one-size-fits-all. Here are popular beginner-friendly approaches:

🔹 50/30/20 Rule

50% to needs

30% to wants

20% to savings or debt

🔹 Zero-Based Budgeting

Assign every dollar a purpose, income minus expenses equals zero.

🔹 Envelope or App-Based Tracking

Divide spending categories into envelopes. Once it’s gone, it’s gone.

Choose one that matches your habits and revisit it monthly.

Step 3: Set Realistic Financial Goals

Goals give your budget direction. Break them into:

Short-term: Emergency fund, paying off credit card debt

Mid-term: Buying a car, saving for a wedding

Long-term: Retirement, homeownership

Make them SMART (Specific, Measurable, Achievable, Relevant, Time-bound).

Example: “Save $1,200 for a vacation in 12 months ($100/month).”

Step 4: Track, Review, Adjust

Consistency is the key to lasting results. Use weekly or monthly check-ins to review:

Overspending patterns

Forgotten subscriptions

Goal progress

Adjustments in income

Even 10 minutes a week can make a big difference.

Research from the CFP Board shows that people with written financial goals are 3x more likely to succeed.

Step 5: Automate Your Wins

Set up auto-transfers to savings after each paycheck

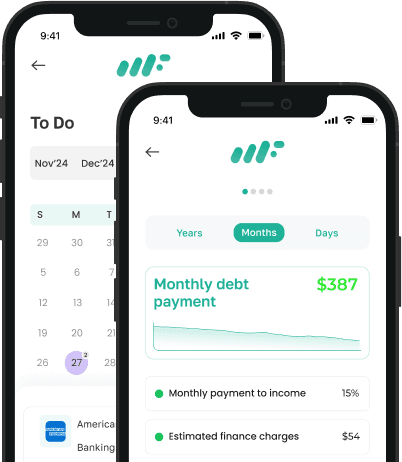

Use budgeting tools with real-time notifications

Get account alerts for low balances, bills due, or large transactions

Automation removes the guesswork and builds financial habits passively.

Step 6: Review and Adjust Monthly

Your budget isn’t static. Review it every 30 days:

Are you overspending in any category?

Did any unexpected expenses pop up?

Are you progressing toward your savings goals?

Regular check-ins help you stay on course and motivated.

Avoid These Budgeting Pitfalls

Being too strict: Budgeting isn’t punishment. Leave room for enjoyment.

Forgetting irregular expenses: Account for yearly costs like car registration or holiday gifts.

Not using tools: Manual tracking often leads to burnout. Use apps like weFi App to automate and simplify.

Final Thoughts

Budgeting isn’t about being perfect, it’s about progress. A good budget gives you freedom, not guilt. It’s the foundation of financial stability, and the sooner you begin, the more confident you’ll feel in every money decision you make.

Whether you're trying to save more, spend less, or simply understand your finances, this guide is the first step toward a life that feels less stressful and more in control.

Frequently Asked Questions

What is the best budgeting method for beginners?

The best method depends on your lifestyle. The 50/30/20 rule is great for beginners, offering a simple way to divide needs, wants, and savings. Zero-based budgeting works well for those who prefer detailed control over every dollar.

How do I start budgeting if I live paycheck to paycheck?

Begin by tracking your spending. Identify essential expenses and cut non-essentials. Prioritize building a $500 emergency fund and automate your savings as soon as income arrives.

How much should I save each month?

Aim to save at least 20% of your income if possible. If that’s too much, start with 5-10% and increase gradually. The goal is consistent progress, not perfection.

Can budgeting help reduce financial stress?

Yes. Budgeting provides clarity and control. According to the American Psychological Association, money is a top stressor but those who budget report feeling more confident and less anxious about their finances.

How often should I update my budget?

Review your budget monthly. Update it immediately after major life events such as a new job, moving, or a change in income or expenses.