How to Control Spending Habits and Save More

Written by

weFiChanging how you spend money isn’t about cutting out joy, it’s about gaining peace of mind, flexibility, and control. Whether you’re living paycheck to paycheck or simply trying to stretch your income further, gaining awareness over your spending habits can unlock real financial freedom.

Why Controlling Spending Habits Matters

Let’s face it; emotional purchases, impulse buys, and lifestyle creep are common. But they add up. According to a 2023 Bankrate survey, nearly 74% of Americans say financial stress is a major source of anxiety, often fueled by poor spending control.

And yet, over 43% don’t track their spending consistently. That gap is where meaningful change begins.

7 Realistic Tips to Control Your Spending and Start Saving

1. Track Every Dollar Honestly

Awareness is everything. Use a budgeting app, spreadsheet, or journal to track every transaction, no judgment, just data. When you see where your money goes, you gain the power to redirect it.

Tip: Categorize your expenses: needs, wants, and unexpected. You’ll be surprised what counts as “non-essential.”

2. Identify Emotional Spending Triggers

Spending often masks emotion. Stress, boredom, sadness, they all can push you to click “Buy Now.”

Pause before any purchase over $25.

Use a 24-hour rule for non-essential items.

Ask: “Do I need this, or am I avoiding something?”

3. Use Cash or Debit for Discretionary Spending

Set a weekly cash limit for dining, shopping, or entertainment. This visual boundary helps you stay accountable without complicated math.

4. Set Specific, Short-Term Saving Goals

Big goals can feel far away. Break them down.

Instead of “I want to save more,” try:

“Save $300 for a weekend trip by September.”

“Put away $100 monthly for holiday gifts.”

Smaller wins build momentum.

5. Automate Savings First, Not Last

Treat savings like a bill. Automate a transfer as soon as your paycheck hits even $25/week builds over time. Out of sight, out of spending temptation.

According to the Consumer Financial Protection Bureau (CFPB), people who automate savings are 2x more likely to meet their goals.

6. Practice the 30-Day Rule

When tempted by a big purchase, wait 30 days before buying. This delay often reveals whether it’s a want or a need. It also removes emotional bias.

7. Use Tools That Keep You Aware

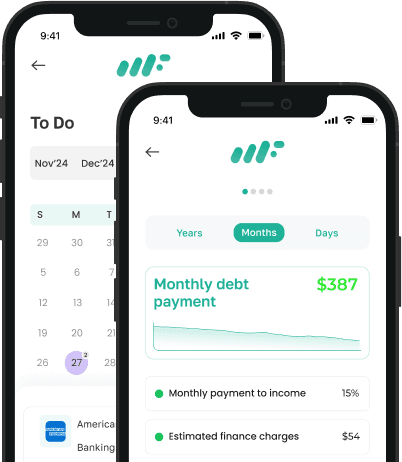

Apps like weFi App help track income, categorize spending, and send alerts — all in one place. Real-time insights prevent blind spending and help course-correct before it’s too late.

What to Do When You Slip

It’s okay to overspend sometimes. What matters is how you respond.

Review your bank statements to understand what triggered it.

Adjust your budget temporarily, reduce non-essentials next month.

Restart. Budgeting is not about perfection, it’s about progress.

Final Thoughts

Saving more money isn’t just about cutting back, it’s about gaining clarity. It’s about knowing what matters and aligning your money with your values. The power to change your financial life doesn’t come from massive paychecks - it comes from tiny, consistent actions.

Start by tracking. Set one small goal. Automate one habit.

And if you need a gentle helping hand, explore tools like weFi App that keep your money organized and goals in view.

Frequently Asked Questions

Why is it so hard to control spending?

Emotional spending, lack of financial visibility, and lifestyle pressure make it difficult. Awareness and structure are key.

What’s the fastest way to start saving?

Automate a fixed amount from every paycheck before spending begins. Even $20/week makes a difference over time.

Are budgeting apps effective?

Yes, apps give real-time tracking, category insights, and spending alerts that help prevent overspending.

How do I stop impulse buying?

Pause. Use the 24-hour or 30-day rule before any non-essential purchase. It breaks the emotional pattern.

Can I control spending without a strict budget?

Yes — using spending caps, cash envelopes, and habit tracking can work if full budgets feel overwhelming.