Personal Finance Mistakes You Must Avoid in Your 20s

Written by

weFiYour 20s are a critical time for building financial stability, yet many young adults make avoidable mistakes that hurt their long-term wealth. But it’s also the time when small money mistakes can snowball into long-term setbacks. From ignoring debt to skipping budgeting, these habits can quietly undermine your financial stability.

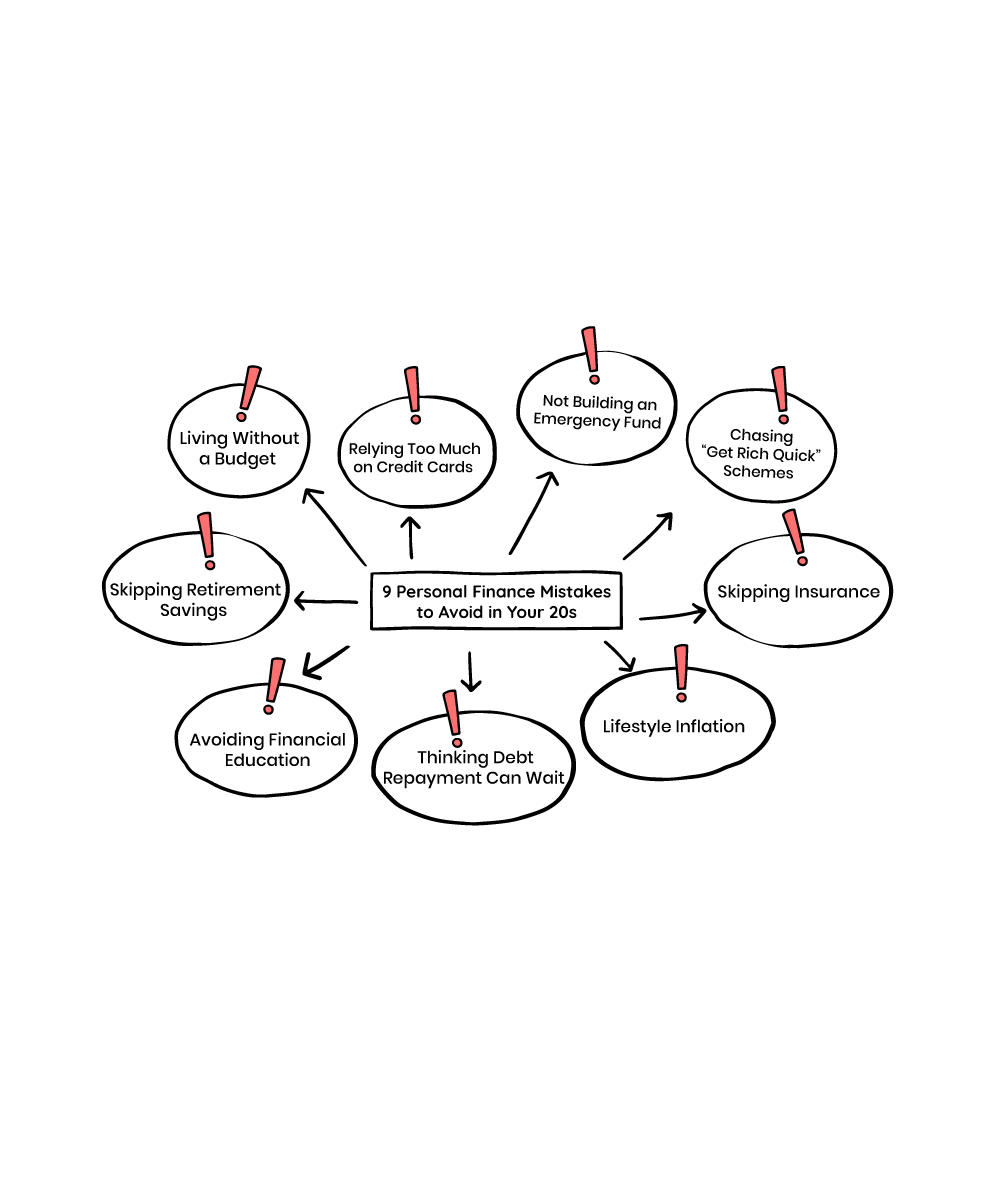

Here are the 9 most common personal finance mistakes people make in their 20s and how to avoid them.

1. Living Without a Budget

Budgeting isn’t restrictive, it’s clarity. Yet many 20-somethings skip this step, assuming they’ll “figure it out later.”

According to a 2023 NerdWallet survey, 24% of Gen Z adults do not have a monthly budget.

How to fix it: Use a budget spending tool like weFi to connect your spending accounts, visualize where your money goes, and build a budget that matches your real life.

2. Relying Too Much on Credit Cards

Swiping without tracking adds up. Many young adults fall into the trap of minimum payments and revolving balances.

According to Bankrate's 2025 Credit Card Debt Report, 47% of Gen Z credit cardholders (ages 18-28) carry a balance from month to month.

What to do:

Only charge what you can pay off in full

Set alerts for due dates

Track balances weekly to avoid surprises

3. Not Building an Emergency Fund

One medical bill or missed paycheck can derail your finances if you don’t have a cushion.

According to Bankrate's 2025 Emergency Savings Report, only 41% of Americans would use their savings to pay for a $1,000 emergency expense, indicating that 59% would need to borrow or use credit.

Goal: Start small: aim for $500, then build toward 3-6 months of expenses. Automate it, even if it's just $10 a week.

4. Skipping Retirement Savings

When retirement feels 40 years away, it’s easy to deprioritize it. But in reality, time is your greatest asset, not income.

Example: If you start saving $100 per month at age 22, and earn a 7% annual return, you’ll have around $327,613 by age 65.

But if you wait just 10 years and start at age 32, you’ll end up with only $154,406 less than half, even though you invested for 33 years.

That’s the power of starting early. Time matters more than how much you invest.

What to do:

Enroll in your employer’s 401(k) especially if there’s a match

Open a Roth IRA and set up automatic contributions

Let compound interest do its thing

5. Avoiding Financial Education

It’s tempting to push financial literacy aside when juggling school, career, or life. But not knowing leads to costly trial-and-error.

Whether it’s student loans, taxes, or investing, avoid “I’ll learn when I need to.” The cost of mistakes is higher than the cost of learning.

Where to start:

Follow trusted finance blogs or podcasts

Learn how to read your credit report

Use personal finance apps like weFi to track and manage your finances

6. Thinking Debt Repayment Can Wait

Waiting to tackle debt, especially student loans or high-interest credit cards is a financial trap.

The longer you delay, the more you pay in interest. Use repayment strategies like the debt snowball (start with smallest balances) or debt avalanche (start with highest interest rate) depending on what keeps you committed.

Not sure which strategy fits? weFi helps you track your progress and stay consistent.

7. Lifestyle Inflation

78% of U.S. workers live paycheck to paycheck (CNBC) often due to overspending.

How to fix it: Follow the 50/30/20 rule:

50% needs (rent, groceries)

30% wants (dining out, travel)

20% savings/debt repayment

8. Skipping Insurance

Insurance might feel optional in your 20s, until something goes wrong.

ER visits average $2,200+ for uninsured patients (KFF 2023).

And 1 in 4 renters experience theft or property damage, yet only 41% have coverage (Insurance Information Institute).

What to do:

Health insurance: Use Healthcare.gov or employer plans to avoid crippling medical debt.

Renter’s insurance: Costs $15/month but covers $30,000+ in liabilities (State Farm).

Term life insurance (if you have dependents): A 30-year-old pays $20/month for $500K coverage (Policygenius).

These are small costs now that prevent massive setbacks later.

9. Chasing “Get Rich Quick” Schemes

TikTok tips. Meme stocks. Overnight crypto plays. It’s tempting to believe you can skip the grind but most fast-money strategies don’t work.

According to FINRA, 80% of day traders lose money, especially when chasing volatile assets like meme stocks or unregulated crypto tokens.

What to do instead:

Skip the hype. Build wealth the proven way:

Invest in low-cost index funds like VTI or SPY

Stay consistent, automate contributions, and give it time

Real wealth doesn’t come from gambling, it comes from strategy and patience.

Final Thoughts

Your 20s are your best chance to build wealth, avoid these mistakes, and you’ll be miles ahead of your peers.

Need help managing your money? Explore weFi’s smart financial tools to budget, save, and invest with confidence.

Frequently Asked Questions

What are common personal finance mistakes to avoid in your 20s?

Skipping budgeting, overusing credit cards, ignoring retirement savings, and delaying debt repayment are some of the biggest financial mistakes young adults make.

Why is budgeting important in your 20s?

Budgeting helps you control spending, plan for goals, and avoid unnecessary debt. Starting early builds discipline and prevents bad habits.

How much should I save in an emergency fund in my 20s?

Start with $500, then aim for 3-6 months of expenses. Saving even small amounts consistently is key.

When should I start saving for retirement?

The earlier, the better. Starting in your 20s gives your money decades to grow through compounding, even small contributions make a big difference.

Should I pay off debt or invest first?

Follow this rule: Debt >7% APR: Pay it off first. Debt <7% APR: Invest while making minimum payments.