Top 7 Benefits of Using a Personal Finance App in 2025

Written by

weFiManaging money used to mean spreadsheets, notebooks, or a dozen tabs open in your browser. Today, personal finance apps have completely changed how people budget, save, and stay on top of their financial goals, all from their phones.

Whether you’re trying to pay off debt, stick to a budget, or just track where your money goes, here are 7 real-world benefits of using a personal finance app, and why now is the best time to start.

1. See Your Entire Financial Picture in One Place

One of the biggest advantages of a personal finance app is account aggregation. These tools sync with your bank accounts, credit cards, savings, and even investments, so you can view everything in one dashboard.

👉 No more logging into five different apps or forgetting about that old savings account.

2. Track Spending in Real Time

You can’t fix what you don’t track. A good finance app categorizes your transactions automatically (groceries, dining out, bills, etc.) and shows exactly where your money is going day by day, week by week.

👉 This kind of visibility helps you spot habits, plug spending leaks, and adjust before you overspend.

3. Stay on Top of Bills and Due Dates

Late fees are an easy way to waste money. Many personal finance apps let you set bill reminders, track due dates, or even enable push notifications so nothing slips through the cracks.

👉 Some apps also track subscriptions great for canceling things you forgot you were paying for.

4. Set Custom Budgets That Actually Work

Forget cookie-cutter budget templates. With a finance app, you can set personalized spending limits based on your goals whether it’s eating out less or saving for a vacation.

👉 You’ll also get alerts when you’re close to going over budget, so there are no surprises.

5. Make Saving Automatic and Effortless

Some finance apps include built-in savings features that automatically move small amounts of money to your savings account. Others help you set and track specific savings goals like a new laptop or emergency fund.

👉 Automated saving makes consistency easier and it adds up faster than you think.

6. Improve Your Financial Awareness and Discipline

Finance apps turn passive money habits into active ones. Just opening your dashboard regularly can help you feel more in control, reduce stress, and make smarter daily choices like skipping that $8 coffee when you're $20 over budget.

👉 Awareness leads to better habits, and habits drive long-term results.

7. Make Smarter Financial Decisions Over Time

When everything’s tracked, categorized, and visualized, you make better decisions. That could mean reducing credit card debt, increasing your savings rate, or deciding when you’re truly ready to invest.

👉 The best personal finance apps don’t just track your money they help you grow it.

Why It Matters Now

According to a 2024 survey by NerdWallet, 70% of Americans say they feel financially stressed at least once a month and 56% say they don't know where a portion of their income goes.

A personal finance app isn’t just convenient, it's a tool to cut through that confusion and take back control of your money.

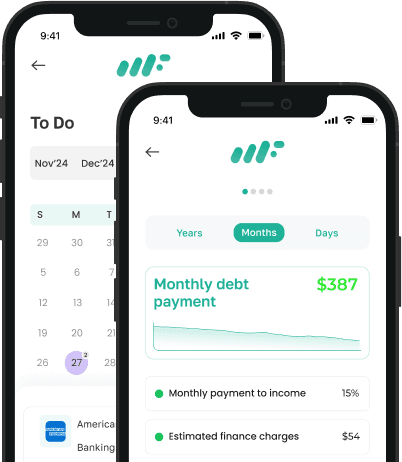

Start Managing Your Money Better with weFi

If you’re ready to take control of your finances, weFi is built for you.

✔ Track spending

✔ Build custom budgets

✔ Set savings goals

✔ Get insights that actually help

All in one app, designed for real life.

Frequently Asked Questions

Are personal finance apps safe to use?

Yes, most trusted apps use bank-level encryption and security protocols to keep your data safe. Always choose reputable apps with good reviews.

Can a finance app help me save money?

Absolutely. Many apps offer tools like automated saving, spending alerts, and custom budgets that help you reduce waste and stay focused on your goals.

Do personal finance apps track credit scores?

Some do. Many modern apps including weFi offer credit score monitoring or integrate with tools that help track and improve your credit profile.

Are personal finance apps better than spreadsheets?

For most people, yes. Apps are faster, more accurate, and automatically sync your data. Spreadsheets require manual updates and aren’t mobile-friendly.

How much does a personal finance app cost?

Many apps are free or offer freemium versions with premium upgrades. You can get started without spending a dime and upgrade later if needed.