How to Use a Budget Calculator to Stay on Track

Written by

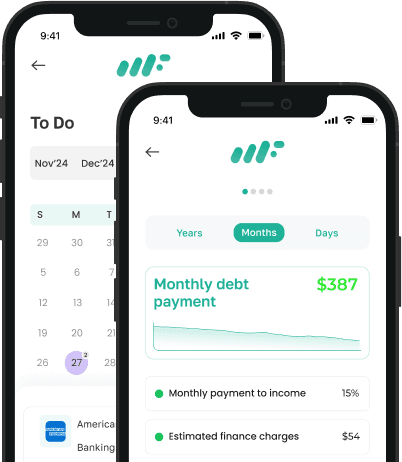

weFiIf you're serious about gaining control over your finances, a budget calculator can be one of your most powerful tools. But it’s not just about plugging in numbers, it’s about using those numbers to make informed decisions that actually stick.

In this guide, we’ll walk you through exactly how to use a budget calculator, what to include, and how to apply the insights to stay financially on track, month after month.

Why Budget Calculators Matter

You might think budgeting is about spreadsheets or willpower. It’s not. It’s about clarity. And clarity starts with knowing exactly where your money goes, and how much you can afford to spend or save.

According to Debt.com’s 2024 survey, about 60% of Americans live paycheck to paycheck, and nearly 20% more people are budgeting now than seven years ago. Despite this progress, a Credit.com study still found that nearly 30% of Americans don’t use a budget at all, often because they believe they don’t need one.

This gap highlights the need for tools that make budgeting simpler and more actionable, like a smart budget calculator.

What Is a Budget Calculator?

A budget calculator is a tool that helps you:

Input income and expenses

Allocate money to different spending categories

Visualize savings goals or debt payoff

Track your progress over time

Unlike general spreadsheets, modern budget calculators offer automation, visuals, and real-time updates that help you make smarter money decisions.

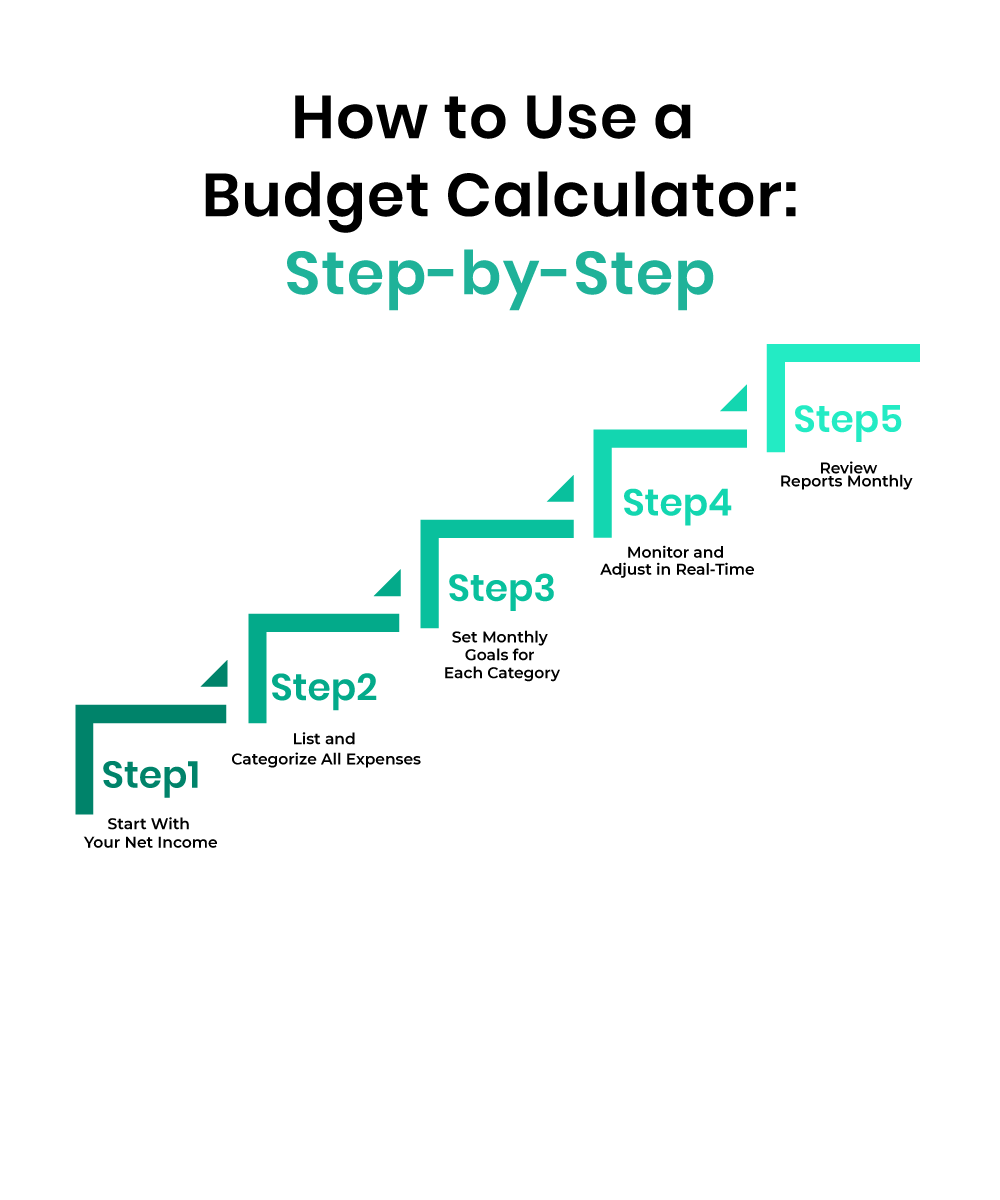

How to Use a Budget Calculator: Step-by-Step

1. Start With Your Net Income

Enter your monthly take-home pay, not your gross salary. Be sure to include:

Salary after taxes

Freelance or gig income

Passive income (rent, dividends)

2. List and Categorize All Expenses

Break down your spending into categories like:

Essentials: Rent, utilities, groceries

Non-essentials: Subscriptions, entertainment

Savings/debt: Emergency fund, student loans, credit cards

Most budget calculators will help you auto-categorize or create custom categories.

3. Set Monthly Goals for Each Category

Your budget calculator should let you assign a spending limit to each category based on your monthly income. One popular method is the 50/30/20 rule, which divides your income into three main buckets:

Example: Monthly Income = $3,000

Category | Allocation | Monthly Limit | Example Expenses |

Needs | 50% | $1,500 | Rent, groceries, utilities, insurance, gas |

Wants | 30% | $900 | Dining out, streaming subscriptions, hobbies |

Savings/Debt | 20% | $600 | Emergency fund, investments, loan payments |

Tip: If your financial goals differ, you can customize these percentages to suit your needs, just make sure the total adds up to 100%.

4. Monitor and Adjust in Real-Time

The best budget calculators update as you go. If you overspend on dining out, the tool should show the impact on your savings or debt goals. That feedback loop helps you pivot before things spiral.

5. Review Reports Monthly

Use visuals like pie charts or progress bars to see:

Where you’re overspending

How much you saved

If you met your financial goals

Why Choose a Digital Budget Calculator Over Manual Spreadsheets?

Feature | Budget Calculator | Manual Spreadsheet |

Auto-categorization | ✅ Yes | ❌ Manual |

Real-time syncing | ✅ Yes | ❌ No |

Visual insights (charts) | ✅ Yes | ❌ Minimal |

Error-proof | ✅ Built-in validation | ❌ High risk |

Common Mistakes to Avoid

Forgetting irregular expenses (e.g., car maintenance, insurance)

Overestimating income (especially for freelancers)

Not checking the calculator regularly

Not updating budget after lifestyle changes

Budgeting is not “set it and forget it.” It's a habit.

Budget calculators aren’t just helpful, they’re essential. If you want to stop guessing and start growing, using a calculator is the most efficient way to take control of your money.

Frequently Asked Questions

What is the purpose of a budget calculator?

A budget calculator helps track income and expenses, allocate money to categories, and stay financially organized by showing where your money is going.

Can I use a budget calculator if my income changes monthly?

Yes. Simply use your lowest expected income for planning and update it monthly. A flexible tool like weFi can adjust your categories in real time.

How is a budget calculator different from an Excel sheet?

A budget calculator is interactive, error-proof, and provides real-time visuals. Spreadsheets require manual entry and formulas, making them more time-consuming and prone to errors.