How to Spend Money Wisely in 2025 - Smart Tips

Written by

weFiMoney Spending Tips That Actually Work

Spending money wisely in 2025 means more than cutting costs; it's about making intentional decisions that reflect your values, goals, and current financial reality. With inflation, rising living costs, and digital temptations all around, smart spending isn’t optional anymore, it’s essential.

Whether you want to save more, avoid unnecessary debt, or just feel more in control of your finances, the tips below will help you spend smarter without feeling restricted.

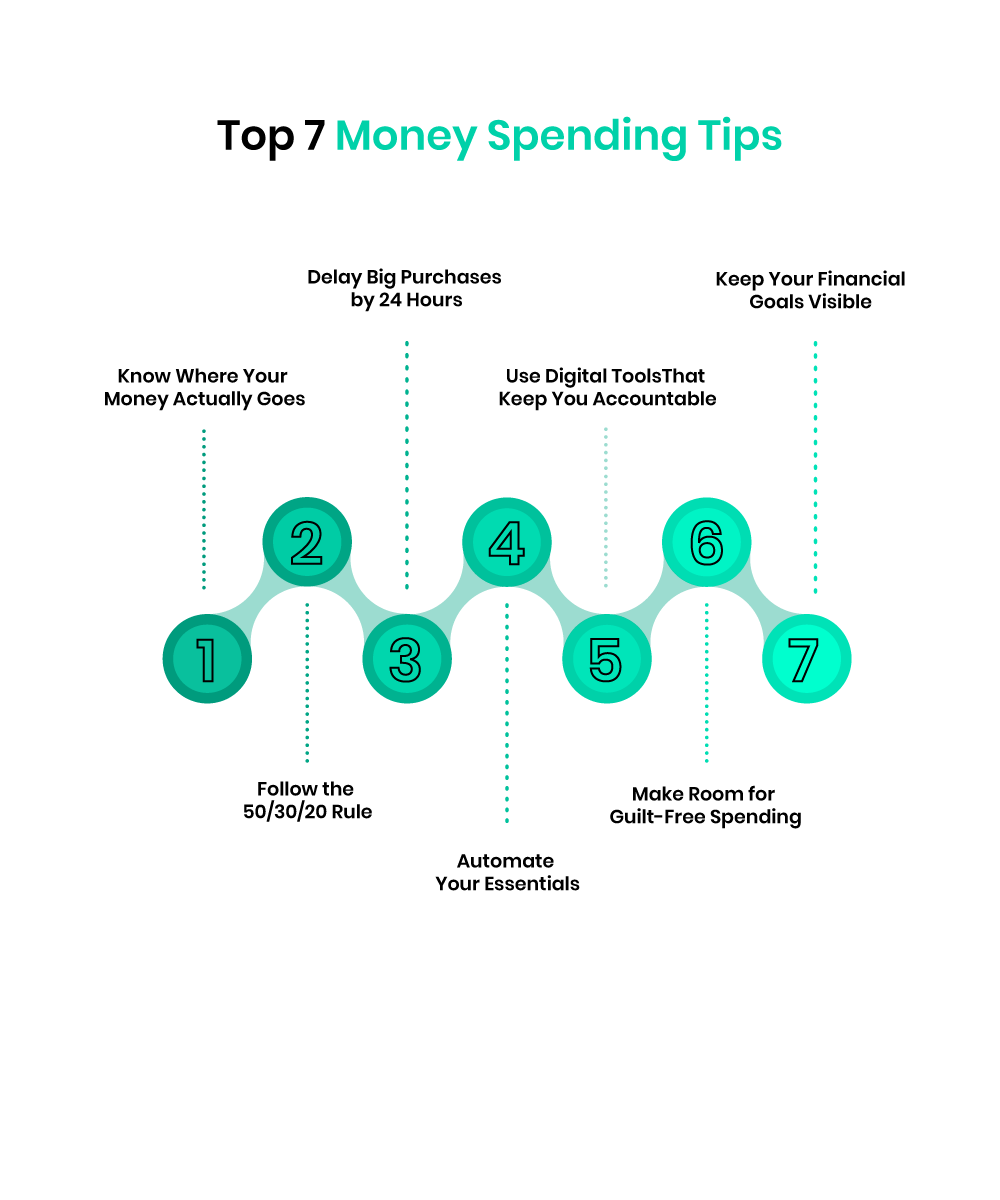

Top 7 Money Spending Tips

1. Know Where Your Money Actually Goes

Before you can spend wisely, you need to understand your current habits. Most people underestimate how much they spend on things like takeout, subscriptions, or daily coffee runs.

👉 Use a budget tracker to monitor your spending patterns.

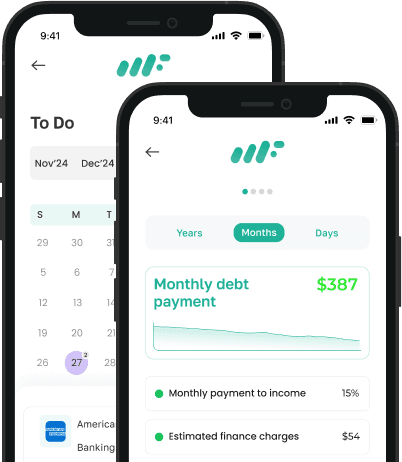

Tools like the weFi Budget Spending Tool can automatically categorize your transactions and provide real-time insights into your spending habits.

A 2024 survey by Clever Real Estate found that 74% of Americans acknowledge having an overspending problem, and 55% admit to spending recklessly. Additionally, nearly half (46%) have missed paying a bill due to non essential spending.

According to WalletHub's 2025 Budgeting Survey, 74% of Americans with a budget cite increasing costs as the biggest challenge they currently face when trying to stick to a budget.

Bankrate's 2025 survey reveals that only 41% of Americans said they would be able to tap their savings to cover an unexpected $1,000 expense, indicating a lack of sufficient emergency funds.

2. Follow the 50/30/20 Rule (or Adapt It to Fit You)

The 50/30/20 rule is a time-tested budgeting method:

50% of income goes to needs (housing, groceries, bills)

30% to wants (entertainment, travel, dining out)

20% to savings and debt repayment

Can’t stick to this exactly? Adjust it based on your income and goals. The key is being intentional with how each dollar is allocated, not just hoping for the best.

3. Delay Big Purchases by 24 Hours

Impulse buys are one of the biggest drains on financial progress. Whether it's a $100 gadget or a new pair of shoes, pause before purchasing.

The 24-hour rule creates space between desire and decision. You’ll be surprised how often the urge to buy fades after a day.

According to a 2023 Slickdeals survey, the average American spent approximately $151 per month on impulse purchases, down from $314 in 2022.

4. Automate Your Essentials - Not Your Lifestyle

Subscription traps can quietly drain your money. In fact, According to a 2025 S&P Global Market Intelligence survey, 27% of U.S. internet adults have reduced their online video subscriptions compared to the previous year, highlighting a growing awareness and adjustment in subscription spending habits.

✔️ Automate your fixed essentials like rent, utilities, and insurance.

❌ Review and cancel any recurring payments that no longer add value.

5. Use Digital Tools That Keep You Accountable

Smart money decisions need real-time awareness. The weFi Budget Spending Tool connects to your accounts, analyzes your spending patterns, and helps you create a realistic budget you can stick to.

You’ll be able to:

Track your spending by category, in real time

Spot trends like inconsistent habits or overspending

Get alerts for large transactions, subscription changes, or potential shortfalls

Adjust your budget over time as your needs change

6. Make Room for Guilt-Free Spending

Spending wisely doesn’t mean eliminating everything you enjoy. If there’s something that makes your day better, your morning coffee, a weekend trip, budget for it on purpose.

When you plan for the fun stuff upfront, it won’t throw off your bigger goals.

7. Keep Your Financial Goals Visible

If you want to spend smarter, make your financial goals hard to ignore. Write them down, keep them where you can see them, and revisit them often.

A study by Dr. Gail Matthews at Dominican University found that people who write down their goals and track their progress are significantly more likely to achieve them compared to those who only think about their goals. It’s a simple habit that boosts commitment and clarity especially when temptation strikes.

Final Thoughts

Spending money wisely in 2025 isn’t about restriction, it’s about intention. When you understand your habits, use the right tools, and set clear goals, you gain more control, not less.

Start today by tracking your spending with weFi Budget Tool and take the first step toward a smarter financial future.

Frequently Asked Questions

What does it mean to spend money wisely?

Spending money wisely means aligning your spending with your priorities and financial goals. It involves being intentional, avoiding impulsive buys, and planning for both short- and long-term needs.

How can I stop spending on things I don’t need?

Track your spending, set clear limits, and follow the 24-hour rule for non-essential purchases. Use budgeting tools like weFi’s Budget Spending Tool to stay aware and accountable.

Is the 50/30/20 rule still useful in 2025?

Yes, it's still a solid framework. But with higher living costs, some people adjust the ratios. The goal is to create a realistic system that still prioritizes needs, wants, and savings.

What are the biggest spending mistakes to avoid?

Common spending mistakes include impulse shopping, unused subscriptions, ignoring budgets, and not setting clear financial goals. These habits can quietly chip away at your progress.

What tool helps manage spending daily?

The weFi Budget Spending Tool helps you stay on top of your money by tracking spending by category, offering budget recommendations, and sending alerts for large transactions or potential shortfalls, so you can adjust before problems build up.