How to Set and Achieve Your Savings Goals Fast

Written by

weFiWhether you’re saving for a new car, a rainy day, or finally paying off that credit card, the key to success is simple: clear goals and a real plan. But “saving money” can feel vague and often overwhelming.

This guide will walk you through how to set and actually reach your savings goals without burnout, guilt, or guesswork.

Why Savings Goals Work Better Than “Just Saving”

When you don’t have a target, it’s easy to under-save, overspend, or abandon the effort altogether.

A specific goal (like “save $3,000 for an emergency fund in 6 months”) gives you clarity, structure, and motivation.

It turns “I should save” into “Here’s what I’m doing and why.”

Simple Steps to Achieve Your Savings Goals Fast

Step 1: Define What You’re Saving For

The more specific, the better. Instead of just “saving money,” try:

$5,000 for a new car down payment

$1,200 to cover 3 months of groceries in case of job loss

$800 for a holiday trip in December

Put a number on it. Put a deadline on it. Put a reason behind it.

Step 2: Break It Into Monthly or Weekly Targets

Big numbers feel less intimidating when you chop them down.

Let’s say you want to save $1,200 in 6 months:

That’s $200 per month

Or $50 per week

Now you have a realistic path, not just a hope.

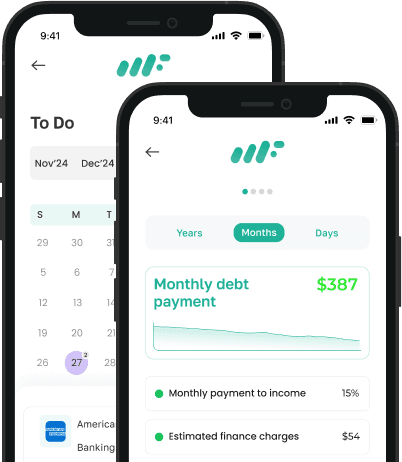

Use tools like weFi to set visual goals, track your deposits, and stay accountable.

Step 3: Automate Your Savings

Manual transfers rely on willpower. Automating transfers makes saving effortless.

Set up a weekly or bi-weekly transfer from checking to savings

Align transfers with payday so you “pay yourself first”

Use bank rules like “round up and save” to boost progress painlessly

Even small amounts $10, $25, $40, compound fast with consistency.

Step 4: Make Room in Your Budget

If there’s no room to save, it’s time to trim. You don’t need to cut everything just enough to prioritize your goals.

Quick adjustments:

Pause one subscription = +$15/month

Make coffee at home = +$60/month

Lower dining out = +$80/month

That’s $150/month right there just from tweaks.

Step 5: Track, Celebrate, Adjust

Use an app (like weFi) or a spreadsheet. Watch your savings grow. If you fall behind one week, don’t quit just course-correct.

When you hit 25%, 50%, or 75% of your goal, celebrate with something free or low-cost. You’re building a powerful habit.

Step 6: Stack Your Goals for Momentum

Once one goal is funded, keep the momentum going. Redirect that savings to your next target without skipping a beat.

This “savings snowball” helps you make faster progress without starting from zero every time.

You Don’t Need More Money. You Need a Plan.

Saving fast isn’t about deprivation. It’s about clarity, intention, and small, consistent steps. With the right tools and a bit of strategy, your savings goals stop being a wish and start becoming reality.

Ready to hit your next goal? Let weFi help you track, plan, and grow your money smarter.

Frequently Asked Questions

How do I choose the right savings goal?

Start with what matters most: emergency savings, debt payoff, or a short-term priority like travel. Keep it focused to stay motivated.

How much should I save each month?

A good rule is to aim for 20% of your income if possible, but even small amounts matter. Adjust based on your budget and deadline.

What’s the fastest way to build savings?

Automate your savings, cut small expenses, and use windfalls like bonuses or refunds. Consistency is key.

Should I save or pay off debt first?

Start with a small emergency fund ($500-$1,000), then focus on high-interest debt while continuing to save something each month.