How to Monitor Your Credit Report the Smart Way

Written by

weFiYour credit report impacts loans, jobs, and even rent approvals. And with identity theft losses surpassing $23 billion in 2023 (Javelin Strategy, 2024), proactive credit monitoring is no longer optional. Monitoring it regularly helps you catch errors, prevent fraud, and improve your score. But most people don’t check it until something goes wrong.

Here’s how to monitor your credit report the smart way without stress, confusion, or risk.

Why Monitoring Your Credit Report Matters

Your credit report is a detailed record of your borrowing history. It includes your credit accounts, balances, payment history, inquiries, and more. Credit bureaus such as Experian, Equifax, and TransUnion compile this information and lenders use it to determine your creditworthiness.

A mistake on your report or signs of fraud can damage your credit score and you may not notice until it’s too late.

34% of Americans have errors on their credit reports (FTC).

1 in 5 people find mistakes that hurt their scores (Consumer Reports).

Identity theft costs victims $1,300+ on average (Javelin Strategy).

Not monitoring = risking loans, jobs, and lower credit limits.

Pro Tip: Set a quarterly reminder (January/April/July/October) to check your reports. Consistency beats panic fixes.

How Often Should You Check Your Credit Report?

Mistakes on credit reports are more common than most people realize and even small errors can impact your credit score or limit your financial opportunities. That’s why reviewing your credit report regularly is a smart, preventative habit.

Recommended frequency:

At least once every 3-4 months, rotating between the three major bureaus ( Equifax, Experian, and TransUnion )

Or use a credit monitoring tool like weFi to track your score, get alerts about important changes, and access insights to help improve your credit over time.

Where to Access Your Credit Report

Under U.S. law, you're entitled to one free credit report every 12 months from each of the three major bureaus (Equifax, Experian, TransUnion) via AnnualCreditReport.com, which is the only authorized source.

Since October 2023, those free reports have expanded to weekly access, letting you request one report per bureau each week permanently

However, many apps now provide ongoing access to updates, scores, and fraud alerts.

Smart alternative: Use weFi’s Credit Monitoring Tool for 24/7 visibility without damaging your score.

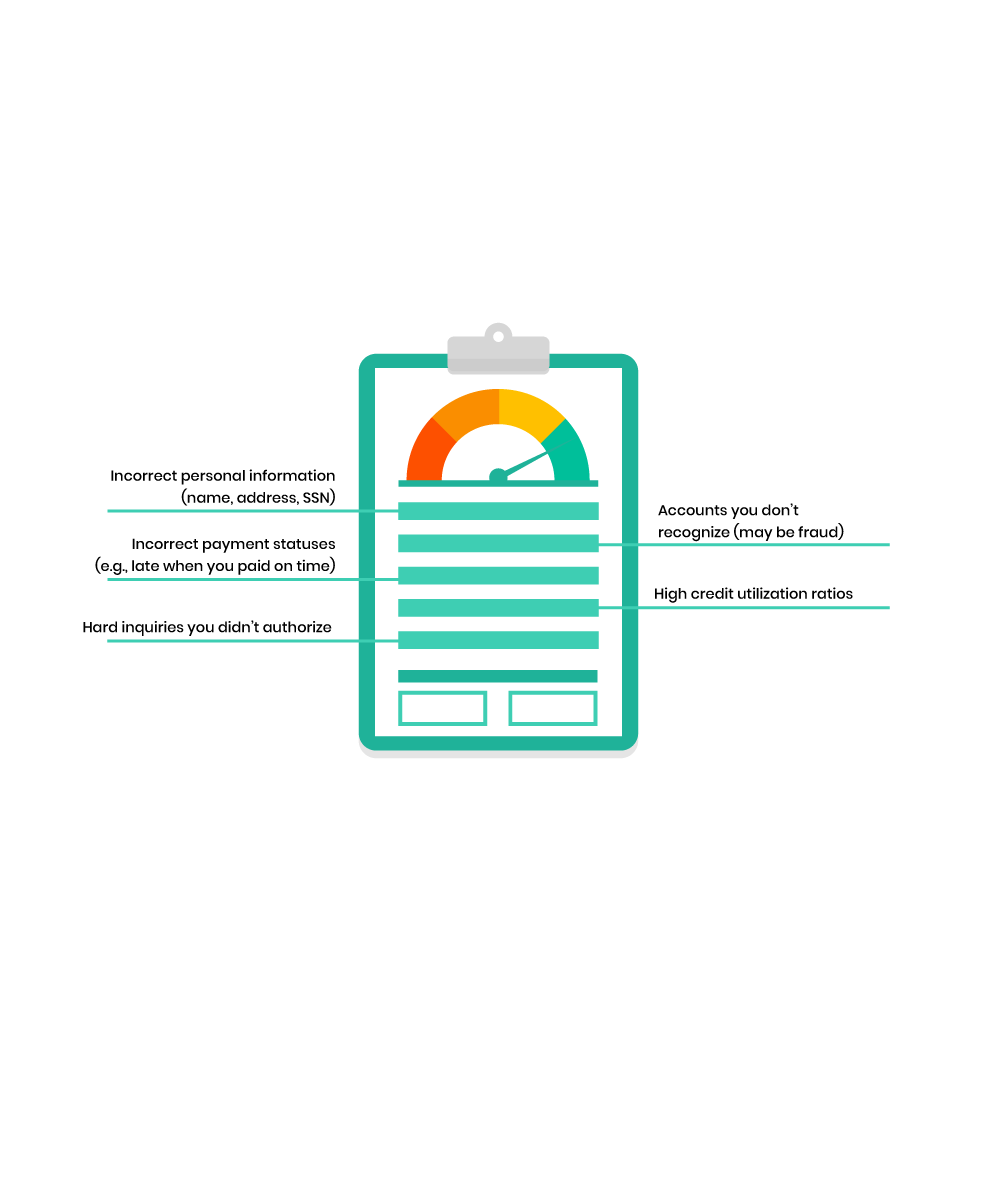

What to Look for in Your Credit Report

When reviewing your credit report, scan for:

Incorrect personal information (name, address, SSN)

Accounts you don’t recognize (may be fraud)

Incorrect payment statuses (e.g., late when you paid on time)

High credit utilization ratios

Hard inquiries you didn’t authorize

Flag anything unusual and dispute errors directly with the credit bureau.

Signs of Identity Theft in a Credit Report

Spotting red flags early can protect you from major damage:

Unknown credit cards or loans

New addresses or employers you didn’t add

A sudden drop in your score

Collection accounts you never owed

If you see any of these, freeze your credit immediately and file a fraud alert.

How Monitoring Tools Help You Stay Ahead

Manual checks are helpful, but smart tools make it easier to stay consistent. Tools like weFi let you:

Get alerts about score changes and other important credit updates

Track up/down trends and view your score in clear, simple terms

Check out tutorials to understand what affects your score and how to improve it

Set reminders for payments, credit usage, and debt goals all from one app

Final Thoughts

Monitoring your credit report takes 5 minutes a month but saves you from:

Denied loans

Higher interest rates

Identity theft disasters

In your 20s, 30s, or beyond, building good credit starts with being informed.

Use weFi to stay one step ahead and make smart financial moves with confidence.

Frequently Asked Questions

What are common errors found in credit reports?

Common errors include misspelled names, outdated personal details, incorrect payment statuses, or accounts you never opened, all of which can lower your score if not fixed.

What are signs of identity theft in a credit report?

Red flags include unfamiliar accounts, hard inquiries you didn’t authorize, or a sudden unexplained drop in your credit score. These may signal identity theft and should be acted on immediately.

What’s the fastest way to dispute errors?

File disputes online (fastest) with each bureau. Include proof like bank statements or ID, and a clear written explanation.

How often do credit reports update?

Lenders typically report every 30 to 45 days, but credit report updates can happen at any time depending on the lender.