How to Build an Emergency Savings Fund from Scratch

Written by

weFiEmergencies don’t wait until you’re ready. Whether it’s a surprise medical bill, job loss, or urgent car repair, having a solid emergency fund can make all the difference between stress and stability. The challenge? Starting one, especially if you're living paycheck to paycheck.

If you’re wondering how to build an emergency savings fund from scratch, you’re not alone. Here’s a straightforward, realistic guide to help you take control of your finances and prepare for life’s curveballs, one step at a time.

Why an Emergency Fund Matters

An emergency savings fund is your financial safety net. It covers unexpected expenses that would otherwise go on a credit card or personal loan.

According to Bankrate's 2025 Emergency Savings Report, only 41% of U.S. adults would use their savings to pay for an unexpected $1,000 expense, such as an emergency room visit or car repair. This marks a decline from 44% in 2024 and represents the lowest percentage since 2021, when it was 39%.

Emergency savings give you peace of mind, flexibility, and the ability to handle surprises without falling into debt.

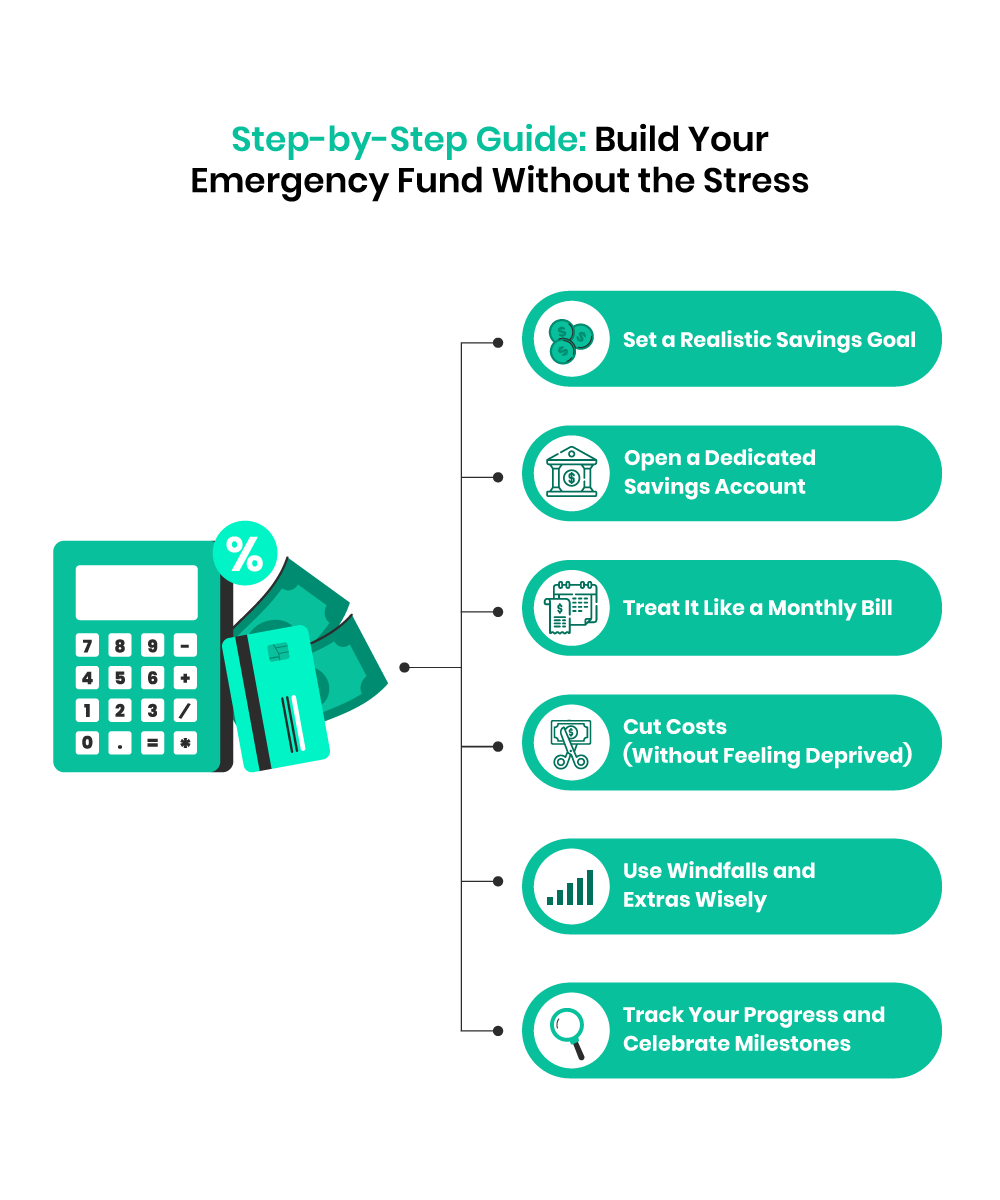

Step-by-Step Guide: Build Your Emergency Fund Without the Stress

Step 1: Set a Realistic Savings Goal

Don’t get overwhelmed by the big numbers, start with something small and do-able.

Starter goal: $500-$1,000 to cover basic emergencies (like a flat tire or urgent vet bill).

Longer-term goal: 3-6 months of essential expenses.

Essential expenses include:

Rent or mortgage

Utilities

Groceries

Insurance

Transportation

Start where you are. If $20 is what you can save this week, that’s your first win.

Step 2: Open a Dedicated Savings Account

Keep your emergency fund separate from your checking account so you’re not tempted to dip into it. Look for a high-yield savings account with no monthly fees and easy access (but not too easy).

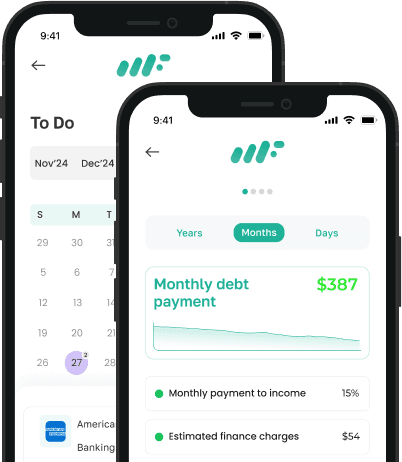

Personal Finance App like weFi can help you track savings goals, monitor your spending, and stay on budget while building your fund.

Step 3: Treat It Like a Monthly Bill

Saving becomes a habit when it’s automatic. Set up a recurring transfer even $25/week adds up to $1,300 a year.

Pro Tip: If your income varies, use percentages instead. For example, save 5-10% of every paycheck.

Think of it this way: You’re not taking money away from your future, you’re protecting it.

Step 4: Cut Costs (Without Feeling Deprived)

You don’t have to give up everything. Look at your current budget and ask:

What can I lower, pause, or replace?

Easy wins:

Cancel unused subscriptions

Cook at home 2 extra nights a week

Buy generic instead of name brands

Use cashback/reward apps and deposit earnings into your emergency fund

This isn’t forever, it’s a short-term sacrifice for long-term peace of mind.

Step 5: Use Windfalls and Extras Wisely

Tax refund? Bonus? Birthday check from grandma?

Instead of spending windfalls right away, put part of that money into your emergency fund to speed up your progress. This is a simple way to boost your savings without touching your regular budget.

Even saving 50% of unexpected income can make a noticeable difference over time.

Step 6: Track Your Progress and Celebrate Milestones

Saving is slow at first but momentum builds. Use a smart budgeting app like weFi to visualize your growth and stay motivated.

Hit $250? Celebrate (cheaply). Reach $1,000? That’s huge. You’re building financial resilience, one dollar at a time.

Ready to Build Yours?

You don’t need a financial degree or a six-figure salary to build an emergency fund. You just need a plan, consistency, and a little patience.

Start small. Stay focused. Your future self will thank you.

👉 Try weFi’s tools to track your income, budget better, and grow your emergency fund smarter.

Frequently Asked Questions

How much should I have in my emergency fund?

Start with $500-$1,000. Long term, aim for 3-6 months of living expenses based on your lifestyle and job stability.

Where should I keep my emergency fund?

In a separate high-yield savings account that’s safe, FDIC-insured, and accessible when needed.

How fast can I build an emergency fund?

Many people build a $1,000 starter fund in 3-6 months with consistent saving and simple lifestyle adjustments.

Should I save for emergencies or pay off debt first?

Ideally, do both, start with a small emergency fund, then focus on paying off high-interest debt while saving.

What counts as an “emergency”?

Medical bills, car or home repairs, and income loss. Not vacations or non-urgent purchases.