How to Build a Realistic Budget That Works for You

Written by

weFiAre you tired of setting budgets that fall apart after a few weeks? You’re not alone. A successful budget isn’t just about cutting costs, it’s about creating a budget plan that fits your lifestyle and financial goals. Whether you're saving for a home, paying off debt, or just trying to manage monthly expenses better, building a realistic budget is the first step to financial control.

In this guide, we’ll walk you through the exact steps to create a realistic budget planner that actually works and sticks.

Why a Realistic Budget Matters More Than Ever

According to a recent CNBC survey, over 60% of Americans live paycheck to paycheck. That means budgeting isn’t a luxury, it’s a necessity. Similarly, a 2024 Bankrate survey found that 59% of U.S. adults feel uneasy about their emergency savings. These stats underline the urgent need for smarter, more realistic budget planning.

A realistic budget helps you:

Gain control over your money

Prepare for emergencies

Avoid debt and improve credit scores

Reach both short- and long-term financial goals

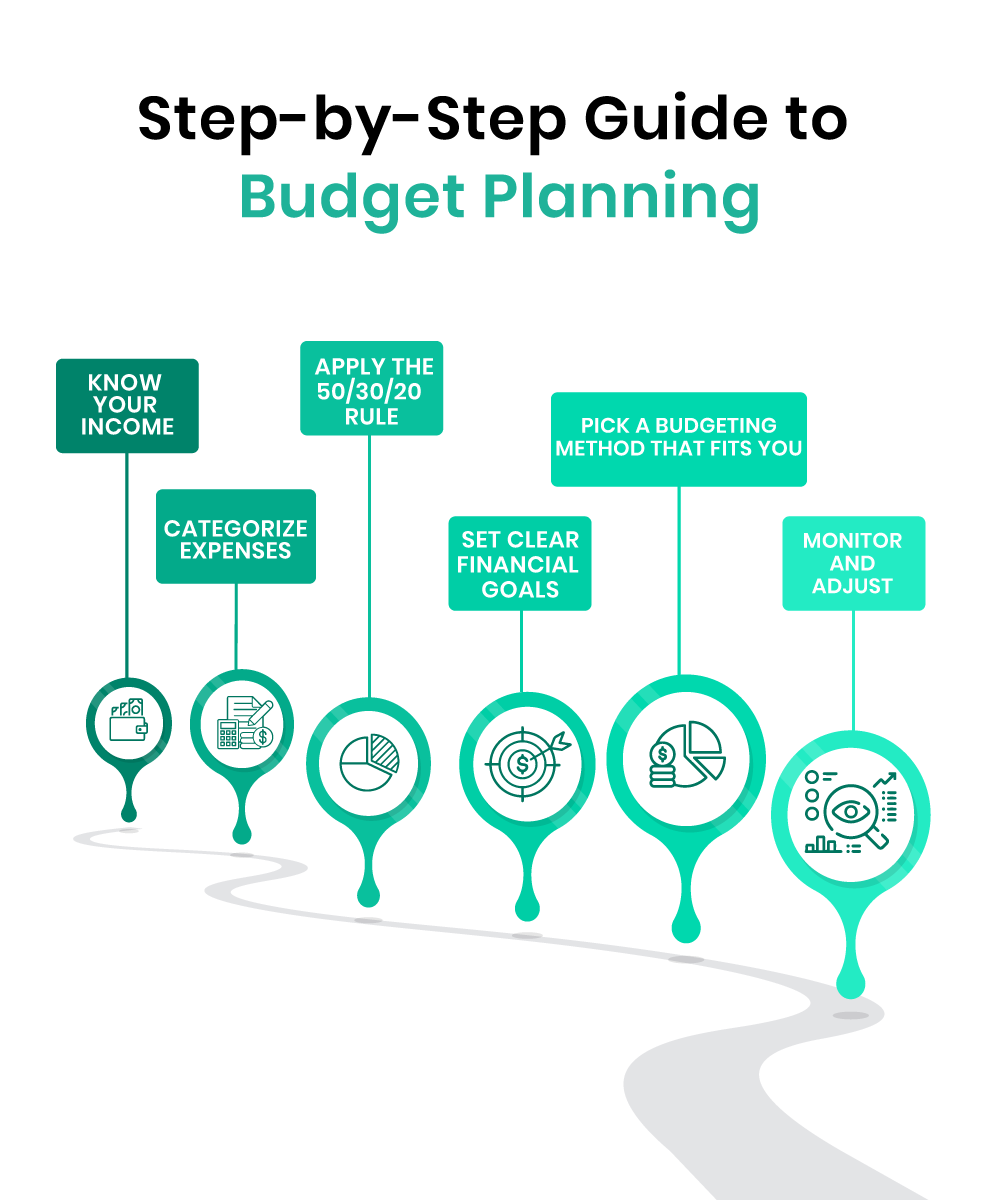

Step-by-Step Guide to Budget Planning

1. Know Your Income

Start by calculating your net monthly income:

Salaries after tax

Side hustles or freelance income

Passive income (e.g., rent, dividends)

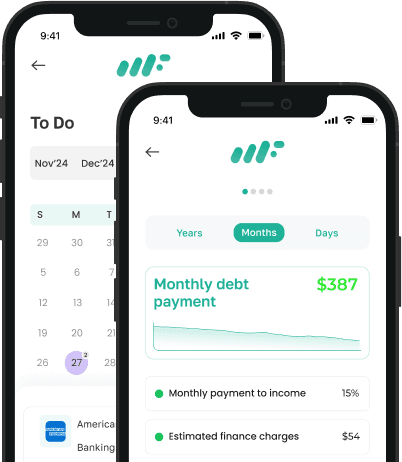

A budget planner tool like weFi can help streamline this process.

2. Categorize Expenses

Break down spending into:

Fixed: Rent, utilities, loan payments

Variable: Groceries, gas, entertainment

Discretionary: Dining out, shopping, hobbies

This reveals where your money actually goes.

3. Apply the 50/30/20 Rule

Allocate your income as:

50% for needs

30% for wants

20% for savings/debt repayment

This flexible model helps maintain balance.

4. Set Clear Financial Goals

Define SMART goals:

Specific

Measurable

Achievable

Relevant

Time-bound

Example: “Save $1,000 emergency fund in 3 months.”

5. Pick a Budgeting Method That Fits You

Zero-based budgeting: Every dollar has a purpose.

Envelope system: Ideal for cash-based spenders.

Digital tools: Like weFi’s budget planner for real-time tracking.

6. Monitor and Adjust

Track spending weekly and adjust where needed. Overspending isn’t failure, it’s feedback.

Common Budgeting Mistakes to Avoid

Ignoring irregular expenses

Setting unrealistic spending limits

Skipping emergency savings

Forgetting to track progress

Want a smarter way to take control of your finances?

👉 Try the weFi - built to help you track, save, and grow.

It’s not just about budgeting. It’s about building a better future.

Frequently Asked Questions

What is the best way to start budgeting?

Start by tracking all your income and expenses. Categorize them, set priorities, and use a reliable budget planner tool to stay organized and consistent.

How much should I save each month?

Aim to save at least 20% of your income if possible. Start smaller if needed and increase over time. Consistency is key.

Are budgeting apps worth it?

Yes. Budgeting apps like weFi provide real-time tracking, goal setting, and personalized insights that help you stay on track.

Can I budget with irregular income?

Absolutely. Base your budget on the lowest income month, and use extra earnings to cover variable costs or boost savings.