How Deposit Alerts Help You Stay on Top of Your Finances

Written by

weFiIn today's fast-paced financial world, staying informed about your money is more important than ever. One of the most effective tools for maintaining financial awareness is deposit alerts - instant notifications that keep you updated whenever money enters your bank account.

Most people check their bank balance obsessively, refreshing apps throughout the day. There's a better way. Deposit alerts eliminate that constant checking while keeping you informed about the money flowing into your accounts.

This comprehensive guide will explain how deposit alerts work, why they're essential for financial management, and how you can use them to gain better control over your finances.

What Are Deposit Alerts?

Deposit alerts are real-time notifications sent by your bank or financial app (like weFi) whenever:

Your paycheck or other deposits hit your account

Someone sends you money via transfer

Mobile check deposits are completed

Unexpected deposits occur (helping detect fraud)

Types of Deposit Alerts Available

Instant Deposit Notifications - Alerts for every deposit, no matter the size

Large Deposit Alerts - Notifications only for deposits above a set amount

Recurring Deposit Alerts - Special reminders for regular income deposits

Pending Deposit Alerts - Notifications when deposits are processing

Why Financial Awareness Matters More Than Ever

A FDIC survey revealed that nearly 4.5% of U.S. households (approximately 5.9 million) were completely "unbanked" in 2021, while many others struggle with financial management. Even among those with bank accounts:

37% of Americans wouldn't be able to cover a $400 emergency expense (Federal Reserve)

59% don't regularly track their spending (Bankrate)

1 in 3 have been late on a bill payment due to forgetfulness (NFCC)

These statistics highlight the critical need for better financial tracking tools - which is where deposit alerts come in.

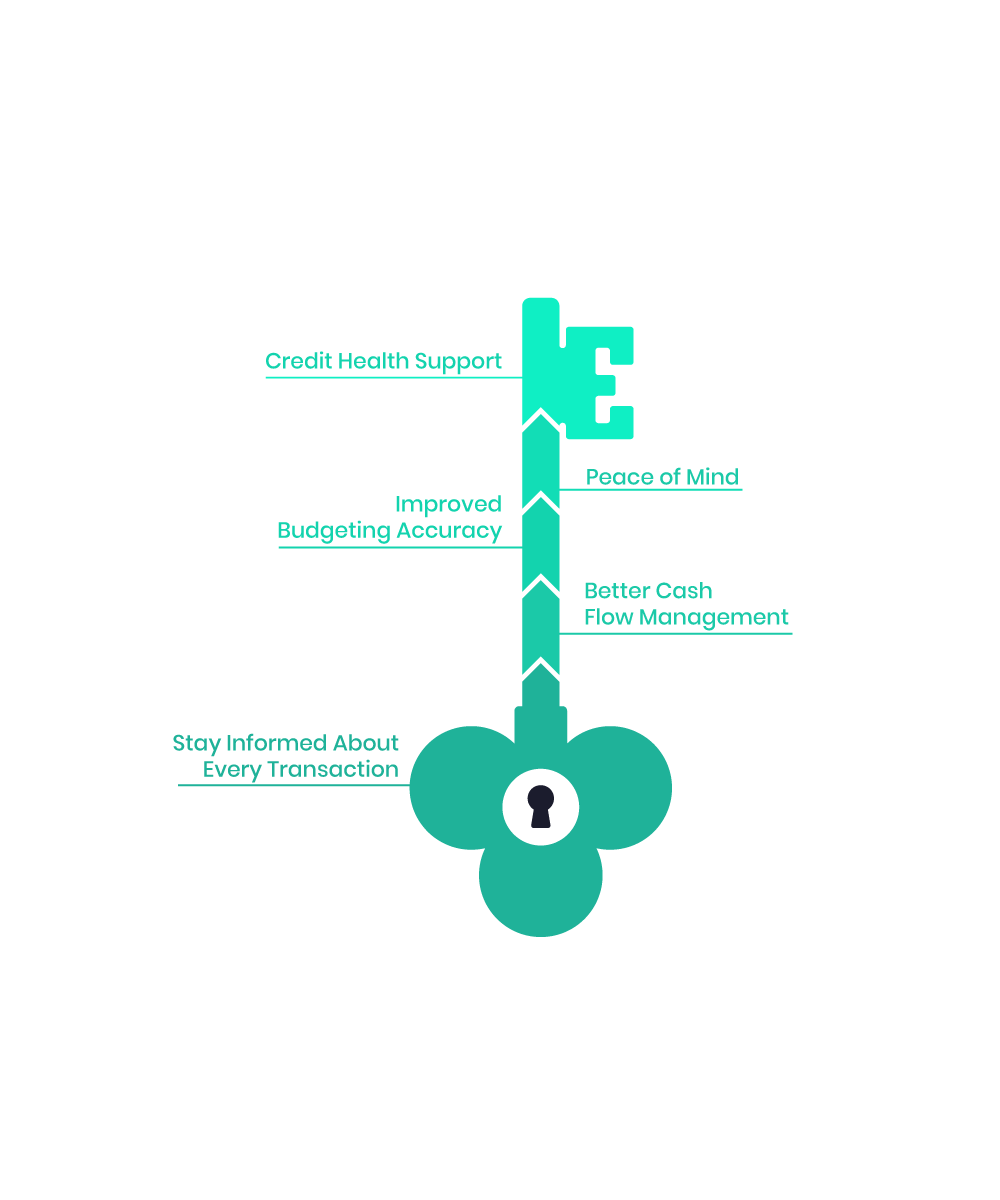

5 Key Benefits of Using Deposit Alerts

1. Stay Informed About Every Transaction

Deposit alerts give you complete visibility into your money movement, helping you:

Verify expected deposits (paychecks, transfers, refunds) instantly

Quickly identify any unexpected or incorrect deposits

Catch potential banking errors before they become problems

Maintain awareness of all account activity for better financial control

2. Better Cash Flow Management

Knowing exactly when money arrives helps you:

Pay bills on time (avoiding late fees)

Schedule transfers between accounts

Make informed spending decisions

3. Improved Budgeting Accuracy

With deposit alerts, you can:

Confirm when freelance payments arrive

Track irregular income sources

Adjust budgets based on actual deposits (not estimates)

4. Peace of Mind

No more:

Wondering if your paycheck deposited

Checking your account constantly

Missing important deposits

5. Credit Health Support

While deposit alerts don't directly affect your credit score, they help by:

Ensuring you have funds for credit card payments

Preventing overdrafts that could lead to collections

Making it easier to maintain positive banking relationships

How to Set Up Deposit Alerts in 3 Easy Steps

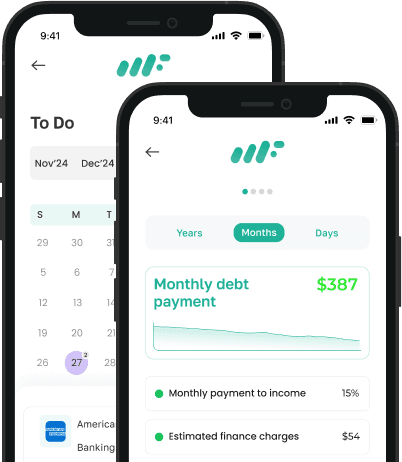

Most banks and personal finance apps including weFi, offer deposit alerts as part of their standard features. While the exact setup may vary, the process is usually simple:

Log in to your online banking or finance app

Find the alerts section

Select deposit notifications from the available alert options

Customize your preferences based on what matters most to you

Pro Tip: Combine deposit alerts with low balance alerts and bill payment reminders for complete financial awareness.

Final Thoughts

Take Control of Your Finances Today

Deposit alerts give you control over your money with zero effort. In an age of fast transactions and online risks, timely notifications keep your finances on track.

Deposit alerts provide:

Real-time financial awareness

Enhanced fraud protection

Better budgeting capabilities

Take the first step toward financial control, download weFi app and turn your money goals into reality.

Simple. Secure. Built for real results.

Frequently Asked Questions

What is a deposit alert?

A deposit alert notifies you when money is added to your bank account. It's usually sent via text, email, or app notification.

Why should I set up deposit alerts?

To track income in real-time, stay within budget, and get early warning for any suspicious activity or errors.

What's the difference between deposit alerts and account balance notifications?

Deposit alerts tell you when money comes into your account, while balance notifications update you on how much money you currently have. Think of deposit alerts as 'money arrived' messages and balance alerts as 'here's what you have now' updates.

Are deposit alerts safe and secure?

Yes, banks use encrypted notifications. For added security, enable two-factor authentication (2FA) on your accounts.

What should I do if I get an unexpected deposit alert?

Verify the deposit in your transaction history. Check if it's from a known source (employer, etc.). Contact your bank immediately if suspicious.

Can I get deposit alerts via text and email?

Most banks offer multiple delivery options including SMS text messages, email notifications, mobile app push alerts, and some even offer voice call alerts.