7 Quick Ways to Improve Your Credit Score

Written by

weFiA strong credit score can open doors; lower interest rates, faster loan approvals, and better financial opportunities. But if your score isn’t where you want it to be, the good news is that improvement is within reach and it doesn’t have to take years.

Here are 7 proven ways to improve your credit score quickly, with steps you can start today.

What Is a Credit Score?

A credit score is a number between 300 and 850 that shows lenders how likely you are to repay borrowed money. In the U.S., the most common scoring model is FICO®.

Here’s a breakdown of FICO score ranges:

300-579: Poor

580-669: Fair

670-739: Good

740-799: Very Good

800-850: Excellent

👉 According to FICO, the average U.S. credit score in 2024 is 717 falling into the “Good” category.

1. Pay Bills On Time - No Exceptions

Payment history makes up 35% of your credit score, making it the most influential factor.

👉 Even one 30-day late payment can lower your score by up to 100 points and stay on your report for seven years. (Source: Experian)

Set reminders, use autopay, or use budgeting tools to ensure nothing slips through the cracks.

2. Reduce Your Credit Utilization Fast

Credit utilization is the percentage of your credit card limit you're using. Experts recommend:

Stay below 30% at all times

For faster improvement, aim for under 10%

3. Don’t Close Old Accounts

Length of credit history counts for 15% of your score. The longer your accounts stay open, the more credit history you build.

Unless the card has a high annual fee, keep older accounts open even if you don’t use them regularly.

4. Check Your Credit Report for Errors

Inaccurate information can drag your score down without you knowing it.

Check your report from all three credit bureaus, Experian, Equifax, and TransUnion through AnnualCreditReport.com.

If you find errors, dispute them immediately. Correcting even one mistake can improve your score significantly.

5. Pay Off Collections Accounts (Smartly)

Wondering does paying off collections improve credit score?

It can, especially newer scoring models like FICO 9 and VantageScore 4.0, which ignore paid collections.

If a collection is still unpaid, negotiate a “pay for delete” with the collector to potentially remove it entirely from your report.

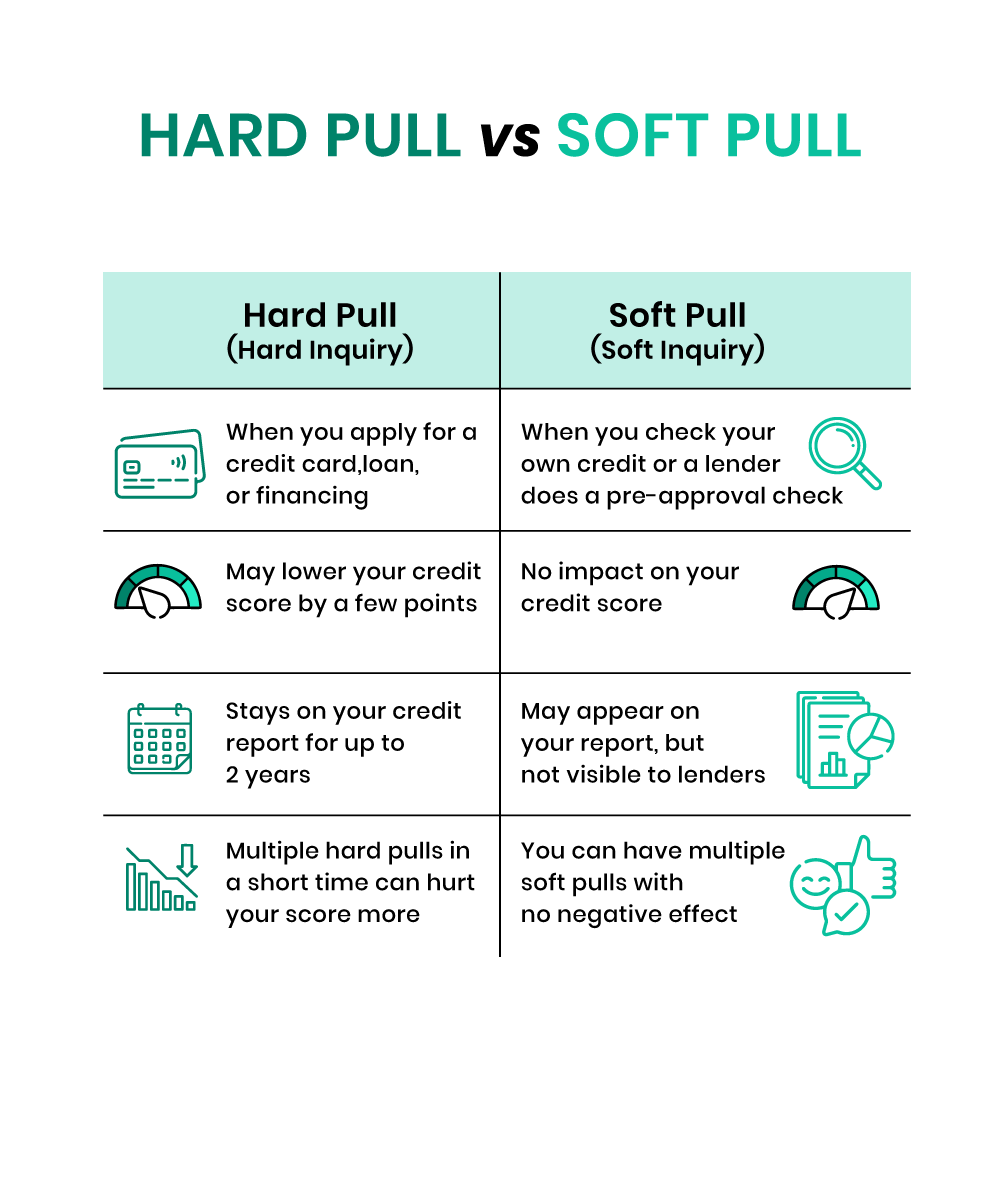

6. Limit New Credit Applications

Every time you apply for credit, a hard inquiry is added to your report.

Too many hard pulls in a short time can hurt your score.

Difference Between a Hard Pull and a Soft Pull:

Hard Pull | Soft Pull |

When you apply for a credit card, loan, or financing, the lender performs a hard pull (also called a hard inquiry). This shows up on your credit report, can lower your score by a few points, and stays visible for up to two years. Applying for too many credit products in a short time can cause those hard pulls to stack up, which can hurt your score even more. | A soft pull (or soft inquiry), on the other hand, happens when you check your own credit, or when a lender runs a pre-approval check. Soft pulls don’t affect your credit score at all. |

Many people mistakenly avoid checking their score, but soft pulls are 100% safe.

Apply for credit only when necessary and space out applications by at least 90 days if possible.

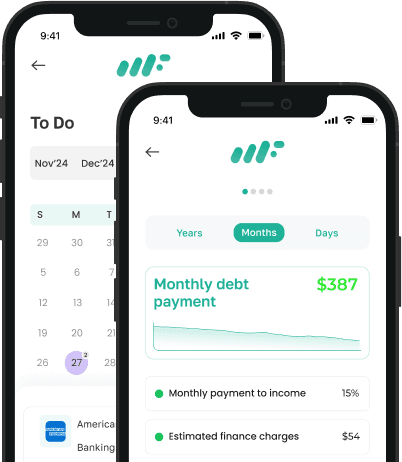

7. Use a Credit Monitoring Tool

Knowledge is power. Track your progress and get alerts about changes to your score by using a reliable tool like:

weFi’s Credit Monitoring.

It helps you stay on top of your financial profile and spot issues before they turn into score damage.

How long does it take to improve a credit score?

If you follow these steps consistently, you could see your credit score begin to improve in as little as 60 to 90 days. Bigger improvements (like 100+ points) may take up to 6 months, depending on your situation.

Your credit score doesn’t define you but it does impact your financial future. With consistent action and the right tools, you can take control and boost your score faster than you think.

Ready to track your progress?

➡️ Start monitoring your credit score with weFi today.

Frequently Asked Questions

What are the fastest ways to improve your credit score?

Pay down credit card balances, dispute errors on your report, and avoid new credit inquiries. These actions can raise your score quickly.

How long will it take for my credit score to improve?

You may start seeing improvements in your score within 60 to 90 days, especially if you’re consistently paying on time and lowering your debt. Larger gains like 100+ points can take up to 6 months or more, depending on your credit history.

Does paying off collections improve credit score?

It can, but it depends on the scoring model. FICO 9 and VantageScore 4.0 ignore paid collections, so paying them off may help your score. Older models, however, still consider them even after payment. Regardless, paying off collections improves your overall creditworthiness with lenders.

How to improve credit score in 30 days?

Start by lowering your credit utilization, making all payments on time, and avoiding new credit applications. Also, check your credit reports for errors and fix anything that’s inaccurate. These steps can create momentum and help improve your score within three months.

Will checking my own credit score hurt it?

No, checking your own score is a soft pull, which does not affect your credit score at all. Only hard pulls, like applying for a loan or credit card, can lower your score slightly.