5 Fun Money Saving Challenges You Can Start Today

Written by

weFiSaving money doesn’t have to be boring or overwhelming. In fact, saving money can actually be fun, if you turn it into a challenge. Whether you’re just starting your savings journey or looking for creative ways to boost your bank account, these 5 money saving challenges are a great place to start. They're simple, low-pressure, and surprisingly effective at helping you save without feeling like you're giving something up.

Here’s how to turn small actions into serious progress and actually enjoy the process.

Why Do Saving Challenges Work?

Saving money isn’t just about discipline, it’s deeply emotional. When stress, excitement, or anxiety kick in, they can heavily influence how (and if) we save.

A 2023 LendingTree survey found that 69% of Americans admit their emotions influence their spending habits, with stress being the most common trigger. And while emotional spending might feel good in the moment, it often leads to regret and even debt.

According to Bankrate’s 2025 Money and Mental Health Survey, 43% of Americans say money negatively affects their mental health, with top stressors including inflation, rising living costs, and lack of emergency savings. For many, these emotional barriers get in the way of building lasting financial habits.

At the same time, emotional spending is on the rise. A 2024 Slickdeals study found that the average American spends $5,400 per year on impulse purchases, often triggered by boredom, stress, or the desire for a quick mood boost.

That’s where saving challenges come in. They give structure, purpose, and a clear reward system, turning a financial habit into something that feels do-able and satisfying. Small wins build confidence, and that confidence can shift your emotional relationship with money.

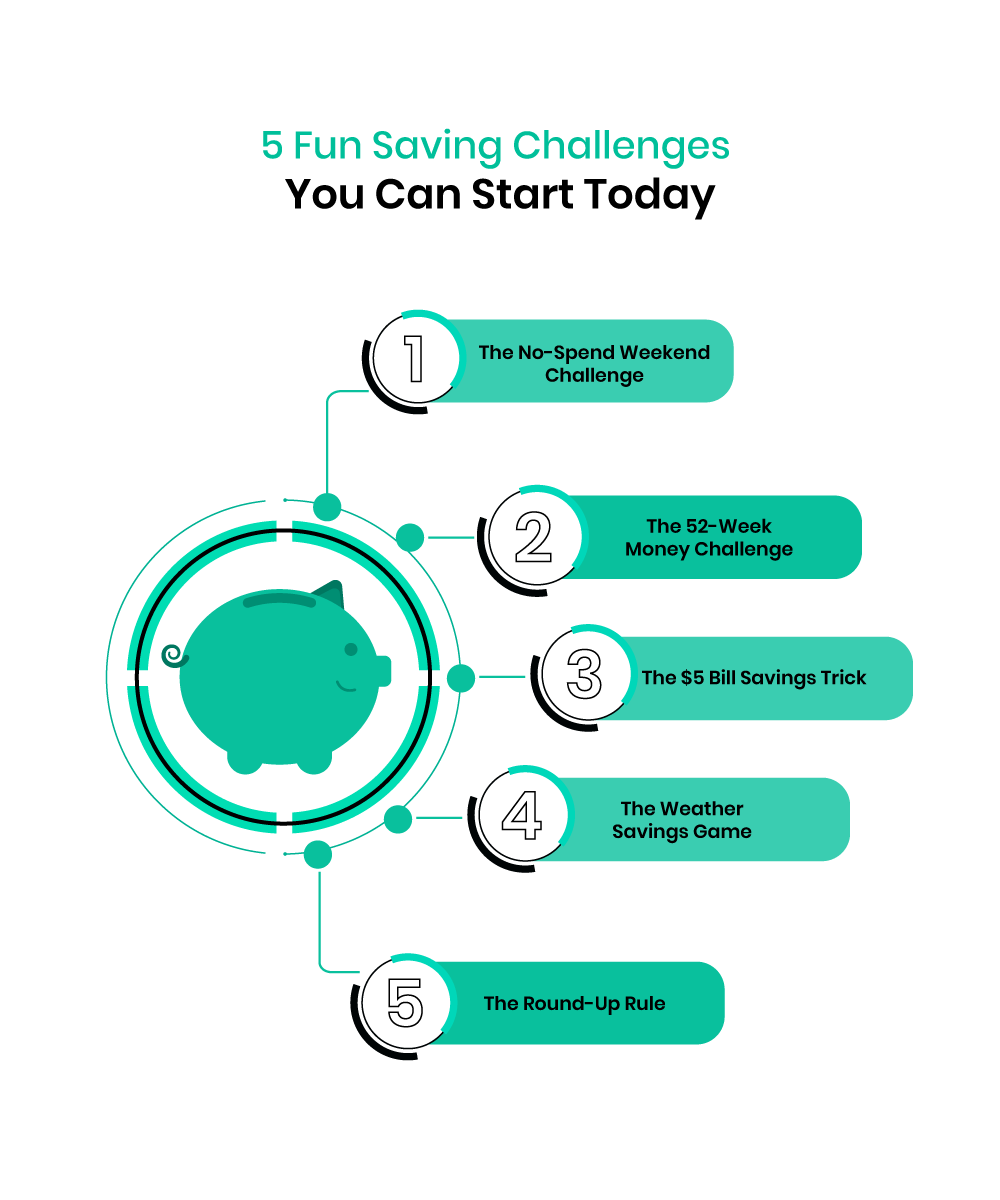

Here are five simple ways to turn saving into a fun and rewarding habit.

1. The No-Spend Weekend Challenge

Choose one weekend a month and commit to spending zero dollars. That means no takeout, no shopping, and no unnecessary spending.

Tip: Prep your meals in advance and plan free activities like nature walks, movie nights at home, or visiting a local museum.

Potential Savings: $50-$150/month

Best For: Curbing impulse spending and resetting habits

2. The 52-Week Money Challenge

Start by saving $1 in week one, $2 in week two, and keep increasing by $1 each week. By week 52, you’ll have saved $1,378.

You can reverse it if you'd like to save more when you have the means: start with $52 and go down by $1 each week.

Potential Savings: $1,378/year

Best For: Building momentum and long-term consistency

3. The $5 Bill Savings Trick

Every time you get a $5 bill in cash, set it aside with no exceptions. You don’t spend and swap it. Just stash it in a jar, envelope, or drawer.

It sounds simple, but it works because it removes the pressure of a fixed number. Over time, those fives add up faster than you think.

Potential Savings: $300-$500/year (based on spending habits)

Best For: Cash spenders and visual savers

4. The Weather Savings Game

Turn Mother Nature into a motivator. Here’s how: Every day the temperature hits a certain number (say, 80°F), you transfer that same amount into savings.

This one’s perfect if you like turning everyday life into a little challenge.

Potential Savings: Varies by climate (e.g., hot summers = higher savings)

Best For: Families, creative savers, and anyone who enjoys a little gamification

5. The Round-Up Rule

Automatically round up each purchase to the nearest dollar and save the difference. Spend $3.45 on coffee? $0.55 goes into your savings pot.

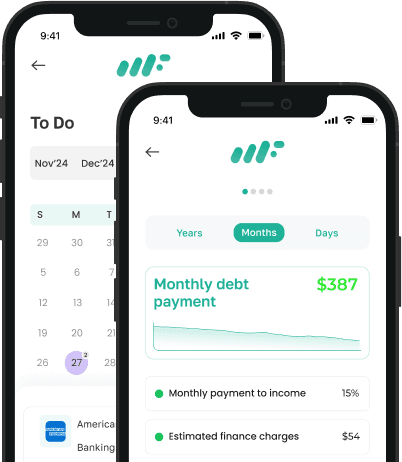

Pro Tip: Use weFi Grow Savings to automate round-ups and track your progress without lifting a finger.

Potential Savings: $20-$50/month

Best For: Passive savers and tech-savvy users

Track Your Progress with weFi Grow Savings

No matter which savings challenge you try, the real progress comes from sticking with it and that’s where weFi Grow Savings makes a difference.

It’s built to help you:

Set savings goals that actually fit your budget and lifestyle

Track your progress in real time, so you know exactly how you're doing

Get alerts and reminders when a transfer is due or if you're falling behind

Adjust your plan anytime because life happens, and flexibility matters

Whether you’re rounding up spare change or aiming for a specific milestone, Just connect your account, follow your custom plan, and let your savings work quietly in the background.

Final Thoughts

Savings don’t have to feel restrictive. With the right mindset, a few fun challenges, and tools that support your goals, you can build momentum and start seeing real progress.

Pick one challenge to try this week and let weFi Grow Savings help you stay on track. Small steps today can lead to big wins down the road.

Frequently Asked Questions

What is a money saving challenge?

A money saving challenge is a structured way to build your savings through consistent, goal-based actions. It often includes weekly or daily goals, rules, and sometimes a gamified twist to make saving feel fun.

Which saving challenge saves the most money?

The 52-week challenge usually saves the most up to $1,378 a year. However, combining smaller challenges like no-spend weekends or the $5 bill trick can help you save even more, depending on how consistent you are.

Do saving challenges actually work?

Yes, they can be very effective. Saving challenges add structure and purpose to your goals, making it easier to stick with good habits and avoid emotional spending.

Can I do more than one saving challenge at a time?

Yes, you can combine saving challenges for better results. For example, pair the $5 bill trick with a no-spend weekend challenge to save faster. Just be sure it fits your budget so it stays manageable.

How can I track or automate my savings goals?

You can use a tool like weFi Grow Savings to build a personalized savings plan, track your progress visually, and get helpful alerts when you're ahead or falling behind. It helps you stay consistent by making saving feel structured, flexible, and manageable.